Mengenal Pola Bearish Harami dalam Forex HSB Investasi

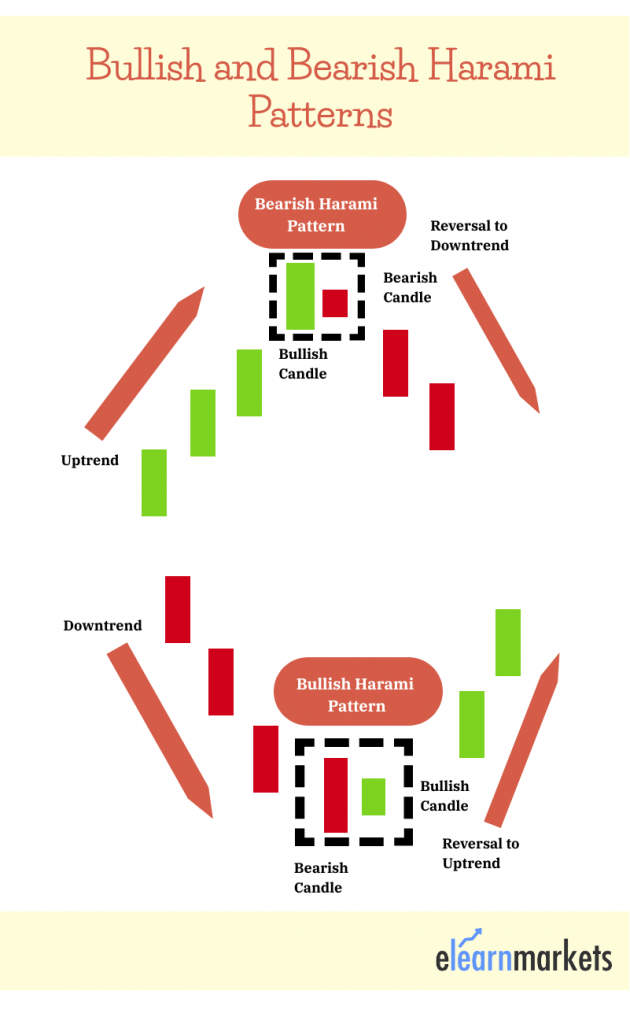

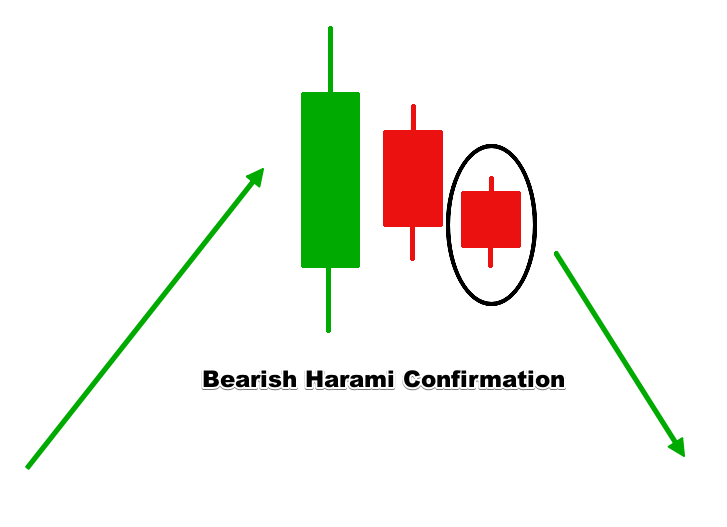

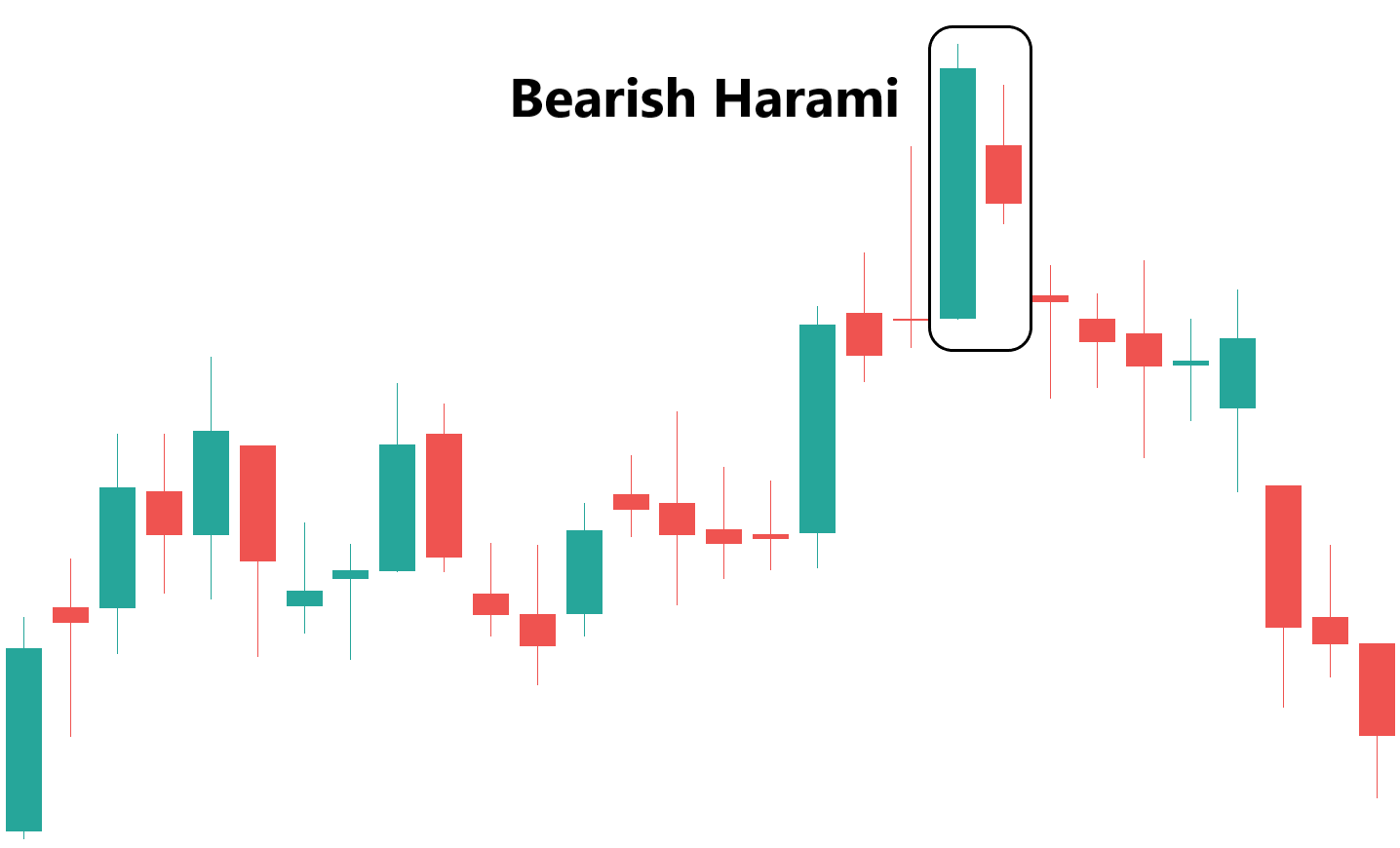

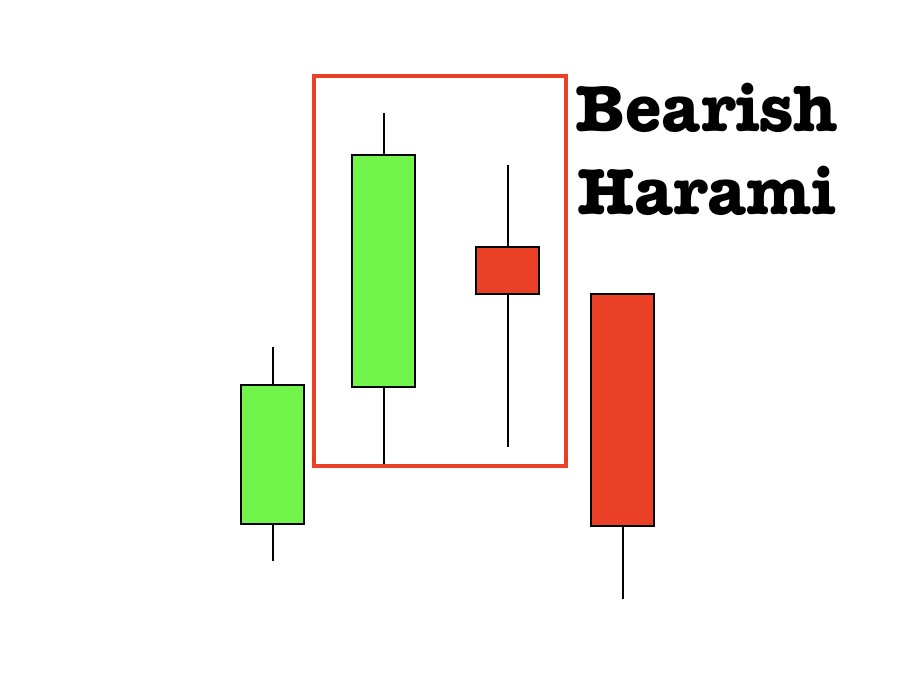

A bearish harami pattern consists of two candlesticks that form near resistance levels where the second candle fits inside the larger first bullish candle. Typically, when the second smaller candle fits inside the first, the price causes a bearish reversal. These patterns are two-day candlestick patterns found on charts.

How to Use Bullish and Bearish Harami Candles to Find Trend Reversals Bybit Learn

Maksudnya, pola Harami tersebut hadir paling cepat dua hari setelah candle bearish terakhir muncul di grafik harga. 3. Perbandingan Ukuran Candle Bearish Terakhir dan Candle Berikutnya. Karakteristik Bullish Harami Candlestick berikutnya adalah ukuran antara badan candle bearish terakhir dengan candle bullish yang muncul setelahnya.

Bearish Harami Là Gì? Cách Xác Định Và Sử Dụng How To Trade Blog

Apa sebenarnya arti istilah bearish dan bulish di pasar saham? Kedua istilah tersebut berasal dari bahasa Inggris, bear yang artinya beruang, dan bull yang artinya banteng. Dilansir dari Investopedia, Selasa (10/8/2021), bearish dan bullish adalah istilah yang digunakan untuk menggambarkan tren di pasar saham secara umum. Bila dilihat.

Belajar Analisis Candlestick Pola Bullish Harami dan Bearish Harami — Stockbit Snips Berita

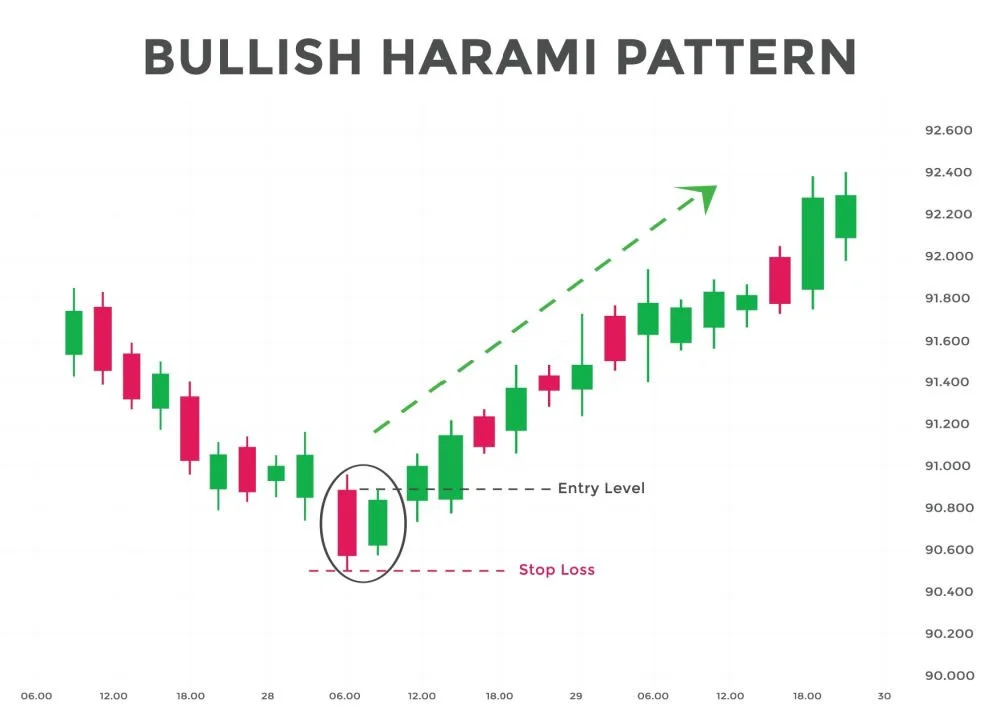

Last Updated on 10 February, 2024 by Rejaul Karim. The bullish harami belongs to the category of most popular candlestick patterns and is relied upon by many traders in their analysis of the markets.. A bullish harami is a two-candle bullish reversal pattern that forms after a downtrend. The first candle is bearish, and is followed by a small bullish candle that's contained within the real.

Bearish Harami Candle Stick Pattern

1. Bullish Harami. Pola ini menampilkan candle pertama berbentuk candle bearish besar, diikuti oleh candle bullish kecil yang sepenuhnya berada di dalam tubuh candle bearish pertama. Interpretasi bullish Harami yaitu menunjukkan bahwa tekanan jual melemah dan pembeli mungkin mulai mengambil kendali. Ini adalah sinyal potensial pembalikan dari.

O que é o padrão Bearish Harami? Como identificar e usar na negociação

Bearish harami signals potential reversals in a bull price movement. Traders often combine it with technical indicators like RSI for enhanced accuracy. Effective trading strategies involve careful consideration of candle sizes, support/resistance, and risk management. Confirmation from multiple indicators is advisable to reduce the risk of.

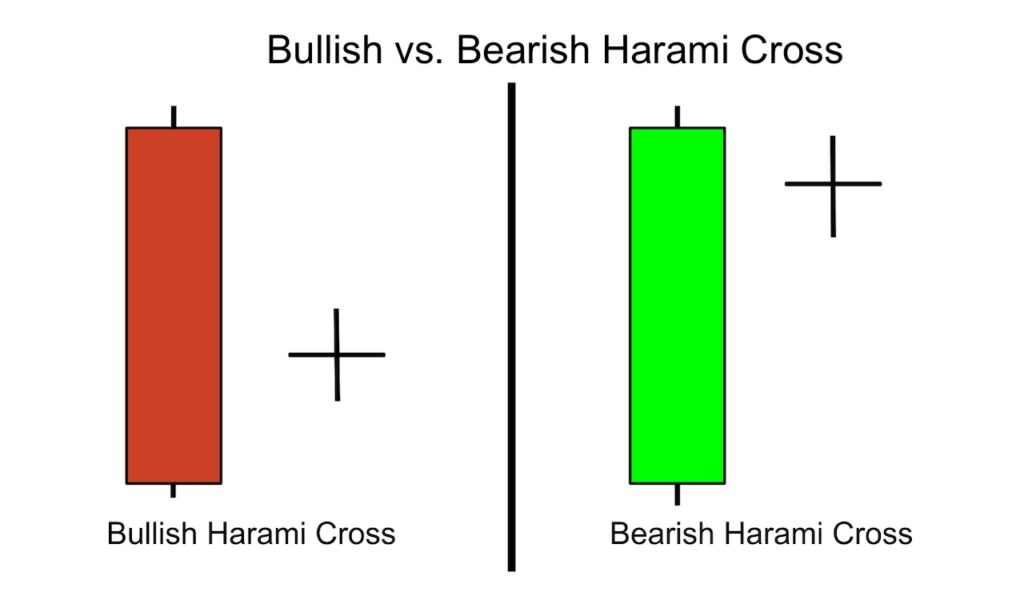

Belajar Analisis Candlestick Bullish Harami Cross dan Bearish Harami Cross — Stockbit Snips

Candlestick adalah salah satu jenis chart yang digunakan dalam investasi saham untuk melakukan analisis teknikal.Terdapat banyak jenis pola-pola candlestick yang bisa dipelajari sebagai sinyal-sinyal pergerakan harga saham.. Salah satunya adalah bullish dan bearish harami menjadi hal yang cukup penting untuk dipelajari.. Pola harami sendiri merupakan pola dalam bentuk candlestick yang.

How to Use Bullish and Bearish Harami Candles to Find Trend Reversals Bybit Learn

Bearish Harami adalah pola kandil khusus, yang menjadi awal dari penurunan harga yang kuat. Pedagang menganggap pola candle ini sebagai poin konfirmasi untuk membuka order DOWN. Untuk mendapatkan hasil maksimal dari pola kandil ini, pedagang sering menggabungkannya dengan indikator tren. Mari kita lihat beberapa kombinasi yang efektif berikut.

The Powerful Harami Candlestick Guide to Bullish and Bearish Harami2022

Bullish Harami: A bullish harami is a candlestick chart pattern in which a large candlestick is followed by a smaller candlestick whose body is located within the vertical range of the larger body.

What Is Bearish Harami Pattern? How To Identify And Use It In Trading

The Bearish Harami Candlestick Pattern is a bearish reversal signal that occurs when a large bearish candlestick follows a small bearish candlestick. This pattern indicates that the bulls were initially in control of the market, but the bears have now taken over and are likely to push prices lower.

What Is Bearish Harami Pattern? How To Identify And Use It In Trading

Bearish Harami Explained & Backtested (2024) The bearish harami is a two-bar bearish reversal Japanese candlestick pattern that suggests volatility is near according to an extensive backtest. If you practice traditional candlestick technical analysis, there's a good chance you're losing money with this three-bar pattern.

Bullish & Bearish Harami Patterns Forex Training Group

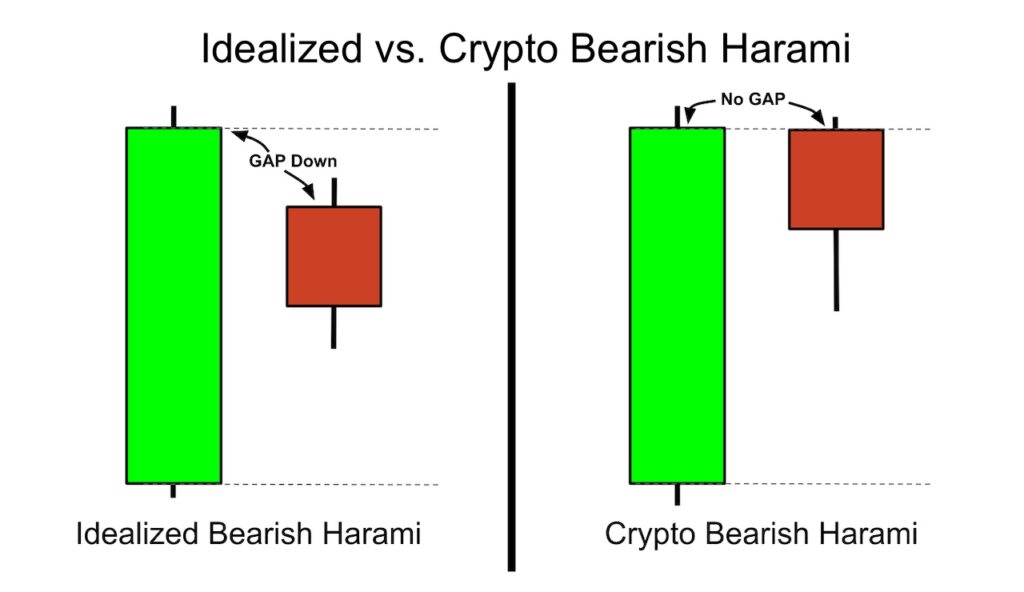

Pola harami terdiri dari candle besar diikuti oleh candle kecil yang tubuh aslinya berada di antara tubuh asli candle besar hari pertama. Selama tren naik, tubuh nyata dari hari pertama adalah bullish dan tubuh nyata kecil hari kedua adalah bearish; namun, tubuh asli hari kedua juga bisa menjadi bullish. Nison (1994, hlm.

How to Use Bullish and Bearish Harami Candles to Find Trend Reversals Bybit Learn

Bullish Harami Pattern: As the strong downtrend is going on the prices keep making lower lows. As the market moves down a long-bodied bearish candle is formed on the first day of this candlestick pattern as per the expectations of the bears. On the second day, the prices open gap up which shows that the bulls are back in action and exerting.

Bearish Harami Candle Stick Pattern

The bearish harami is a two-candlestick pattern that suggests a potential reversal in an uptrend. Traders use this pattern to sell or short a stock or asset, and they confirm the pattern with other technical indicators or price action. It is important to note that the pattern is only a bearish harami if it occurs after an uptrend, and traders.

The Bearish Harami candlestick pattern show a strong reversal

The Bearish Harami pattern is a reversal pattern appearing at the top of an uptrend. It consists of a bullish candle with a large body, followed by a bearish candle with a small body enclosed.

Bearish Harami Là Gì? Cách Xác Định Và Sử Dụng How To Trade Blog

What is a bearish harami pattern in candlestick analysis? Answer: The bearish harami is a bearish reversal pattern in candlestick analysis. It consists of two candles, where the first is bullish, and the second is bearish, with its body confined within the range of the previous bullish candle. This pattern signals a potential negative trend.