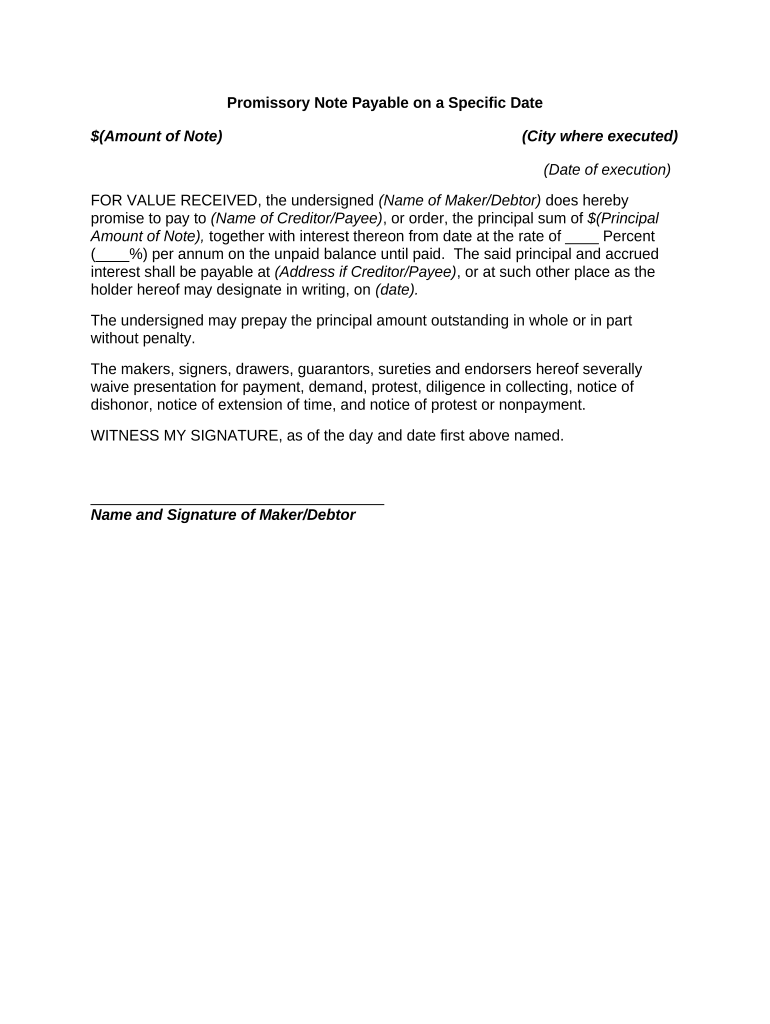

Free Note Payable Template & FAQs Rocket Lawyer

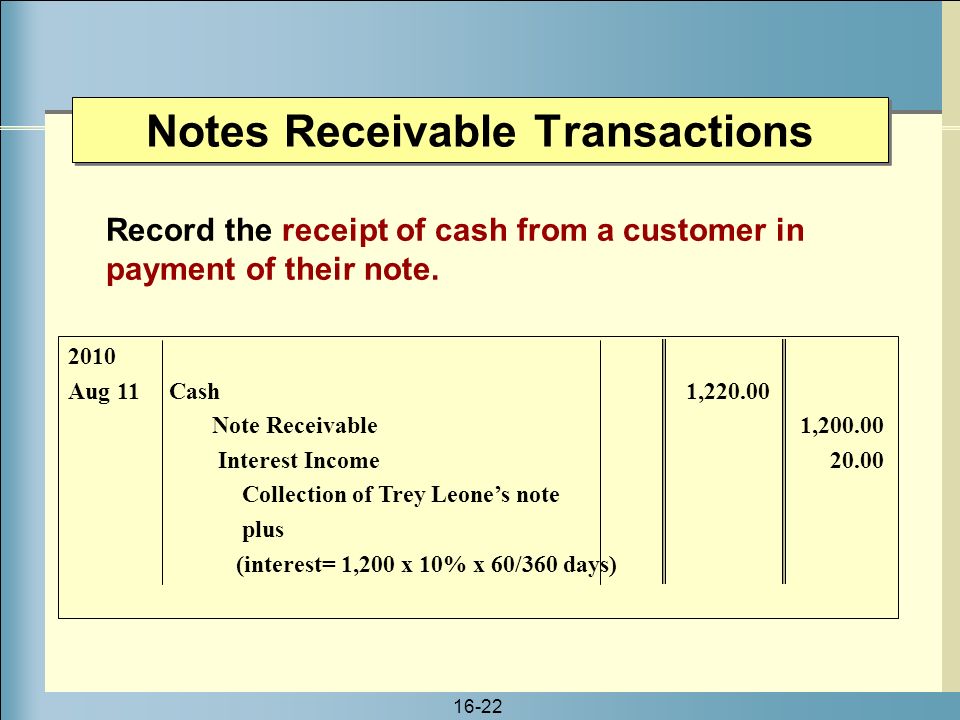

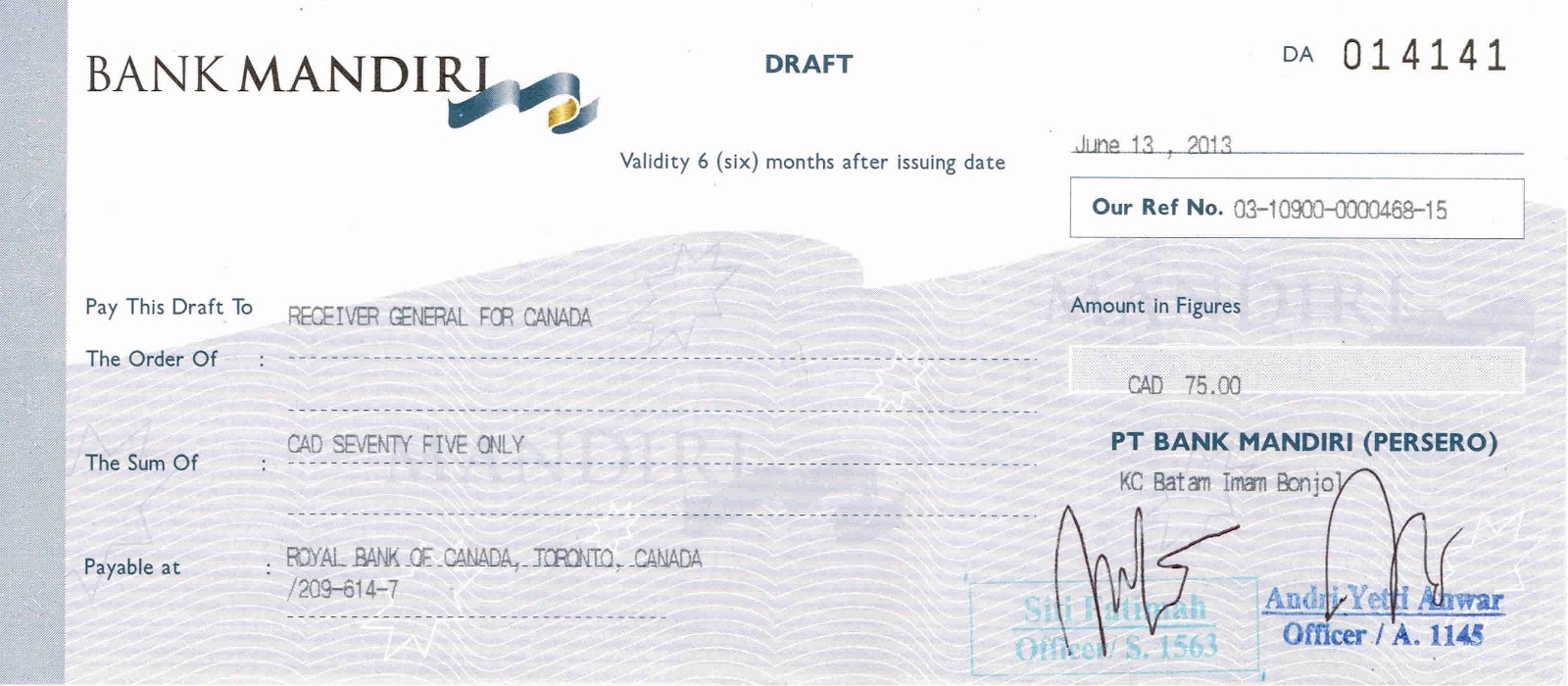

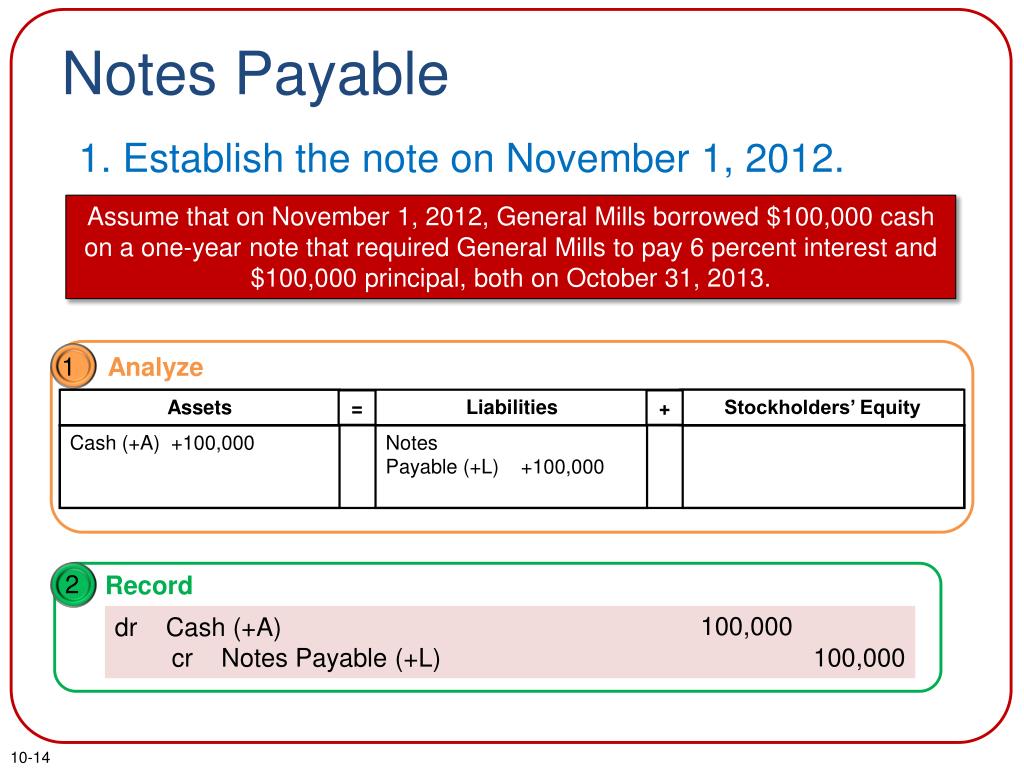

Issuance of the Note. The journal entries to record this note under each of the two cases are: The entry in Case 1 is straightforward. Cash is debited and Notes Payable is credited for $5,000. In Case 2, Notes Payable is credited for $5,200, the maturity value of the note, but S. F. Giant receives only $5,000 cash.

Simple Note Payable Form Fill Out and Sign Printable PDF Template signNow

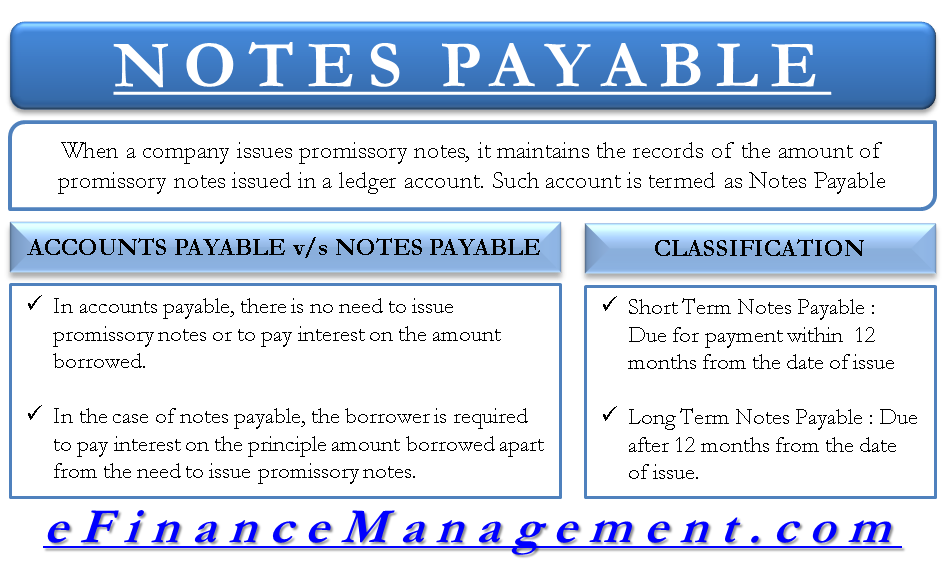

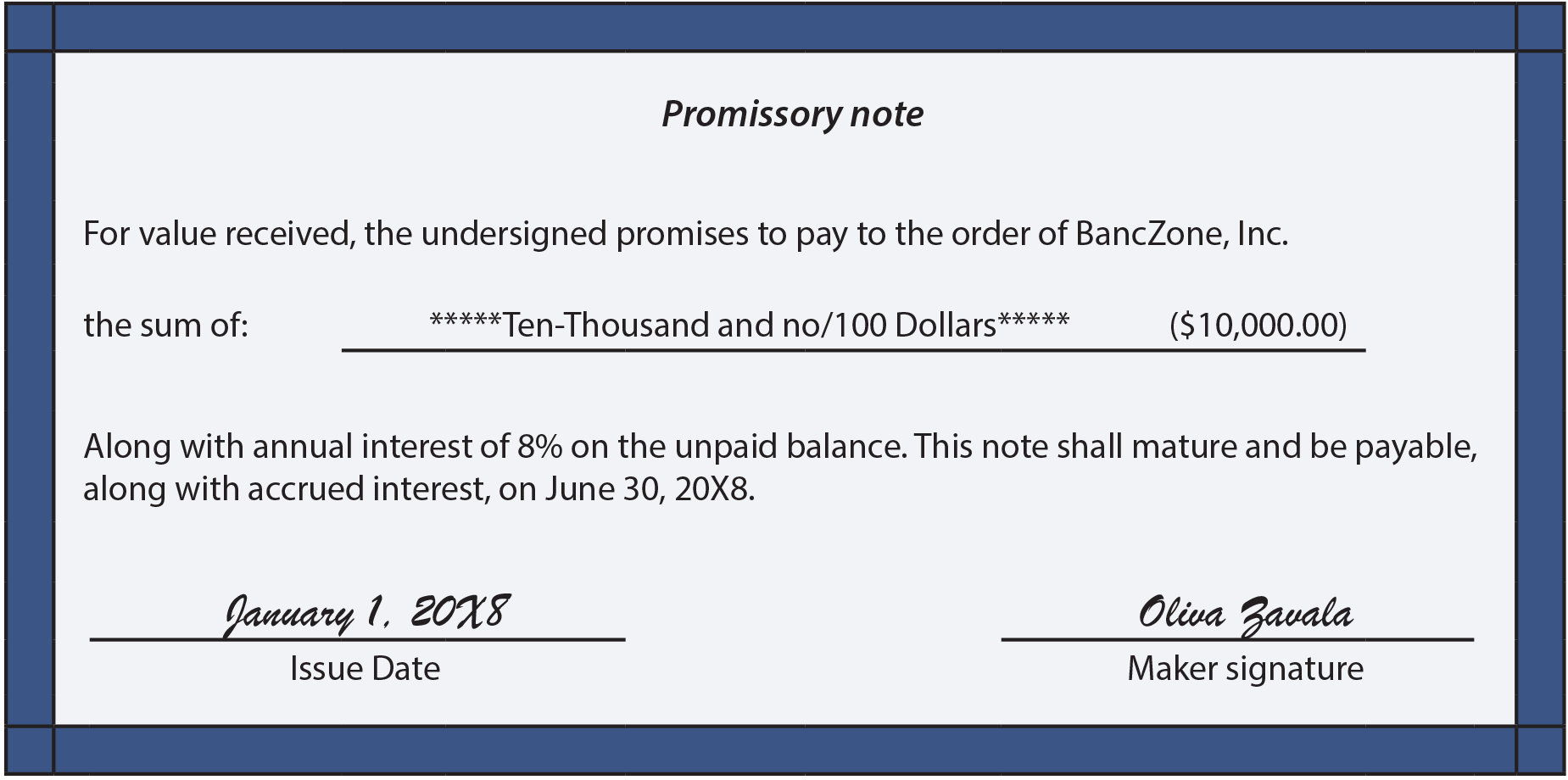

Notes Payable is a written promissory note stating a borrower's payment obligation to a lender and the borrowing terms (interest, maturity). Welcome to Wall Street Prep! Use code at checkout for 15% off. Wharton & Wall Street Prep Certificates Now Enrolling for May 2024 for May 2024:

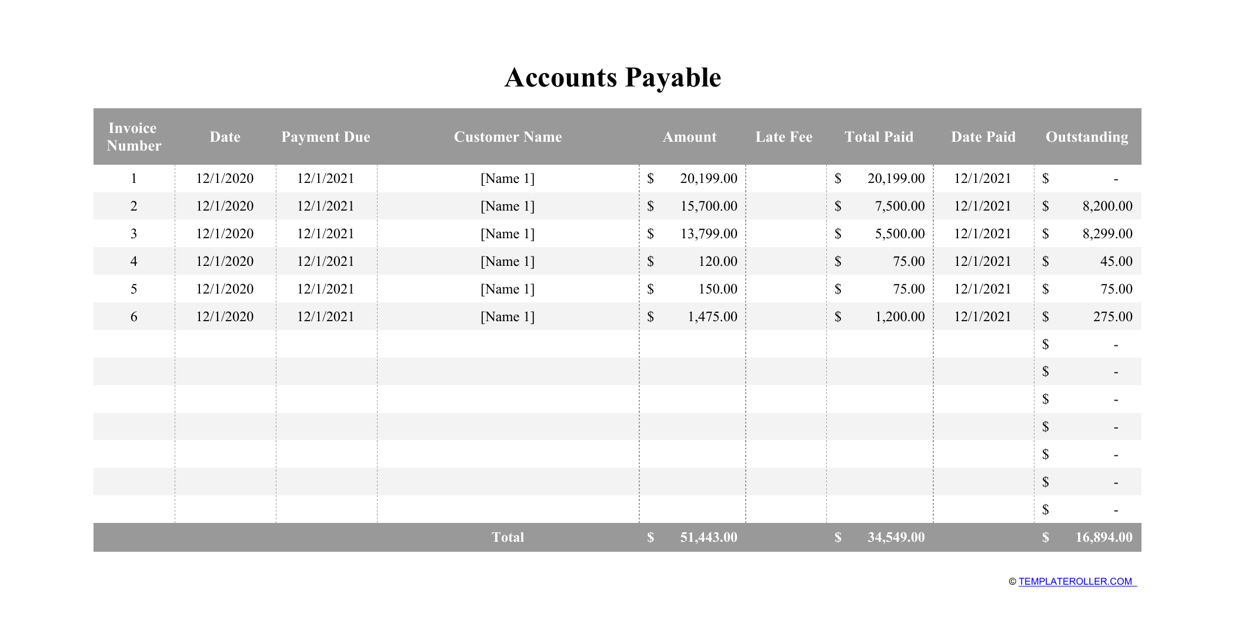

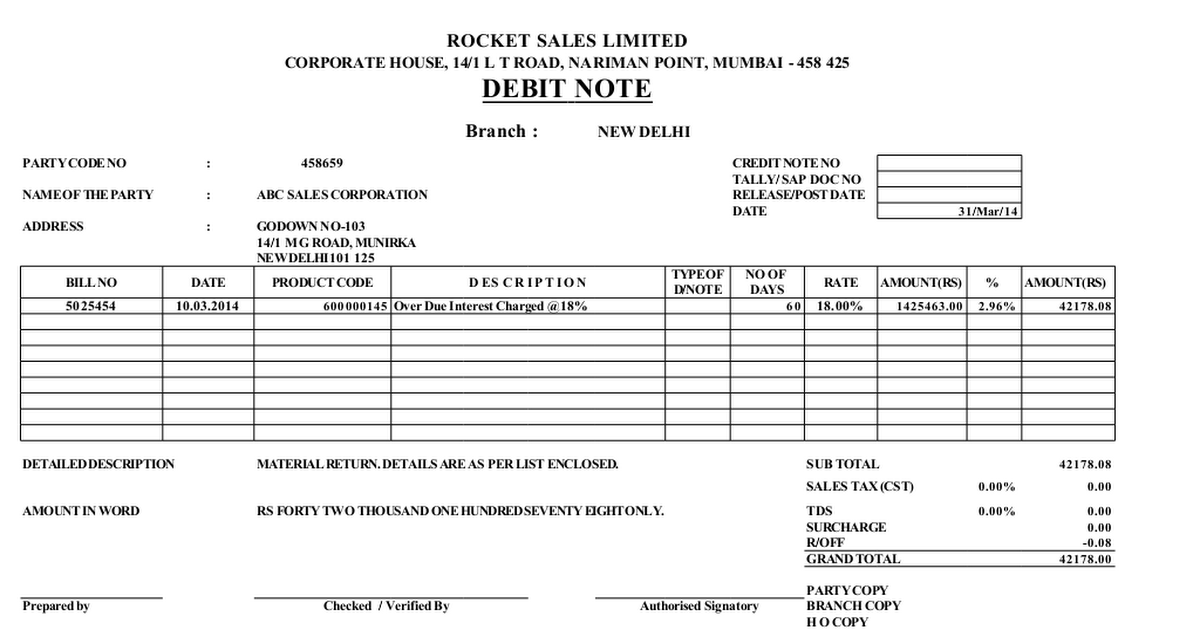

Accounts Payable Template Fill Out, Sign Online and Download PDF Templateroller

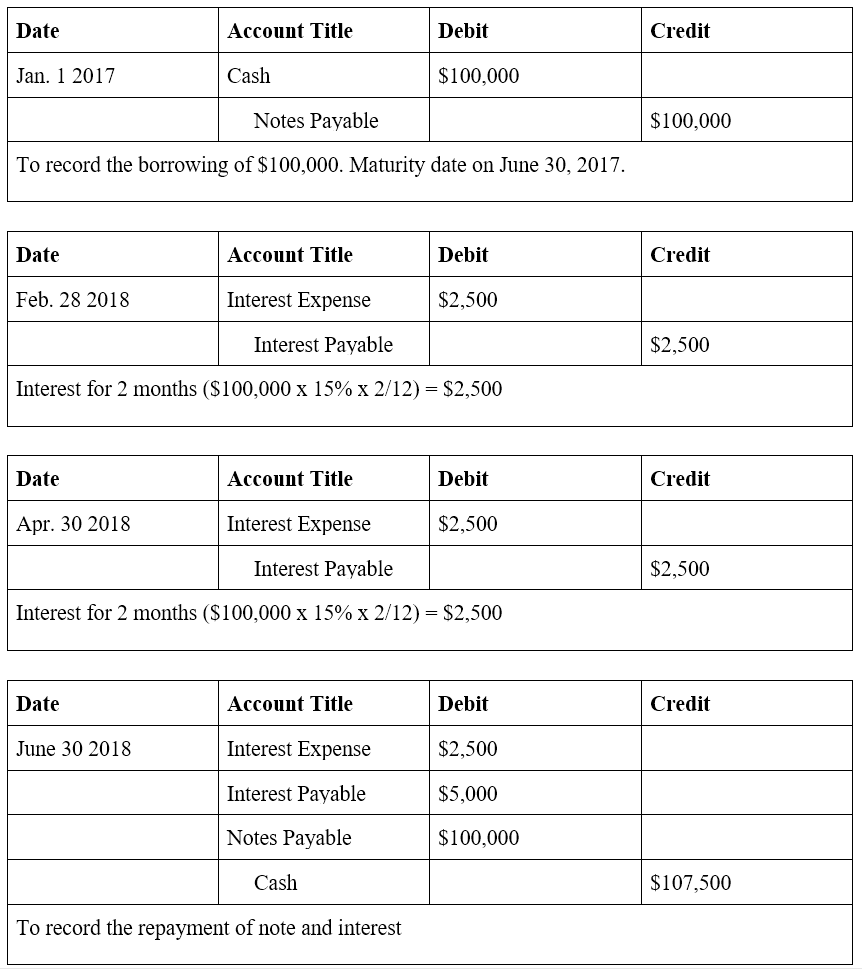

Notes payable example. For example, on October 1, 2020, the company ABC Ltd. signs a $100,000, 10%, 6-month note that matures on March 31, 2021, to borrow the $100,000 money from the bank to meet its short-term financing needs. The company ABC receives the money on the signing date and as agreed in the note, it is required to back both.

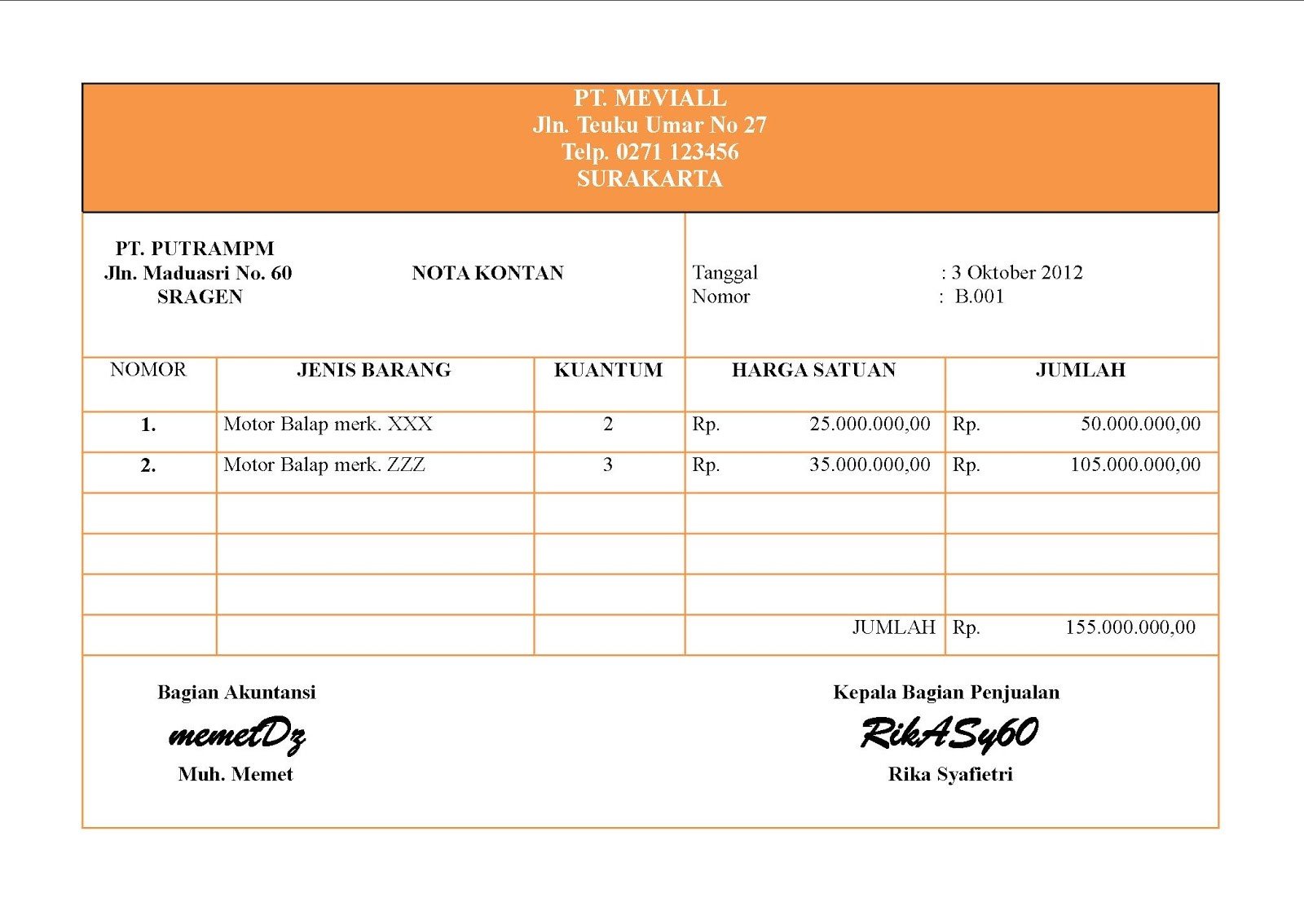

Contoh Credit Note Credit Note Format Free Credit Note Template Zervant Notes Template Credit

Notes Payable Explained. Notes Payable resembles any loan, which binds borrowers and lenders against payment and repayment liabilities.As soon as the agreement is signed, the borrowers receive the amount in cash from lenders with a promise to pay back the amount, which could either be the principal amount alone or the principal along with the applicable interest amount.

Contoh Nota Kontan Penjualan yang Baik dan Benar, Gratis!

The accounts payable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of accounts payable. In each case the accounts payable journal entries show the debit and credit account together with a brief narrative. For a fuller explanation of journal entries.

Notes Receivable Typically Arise From Sales to Customers. BryannahasRobertson

Ada beberapa hal terkait accounting payable yang menarik dipahami. Beberapa contoh account payable adalah sebagai berikut: 1. Pembayaran Vendor. Pembelian bahan baku dengan sistem cicilan tentu melibatkan vendor luar perusahaan. Pembayaran vendor atas kredit bahan baku ini juga masuk ke dalam hutang usaha. 2.

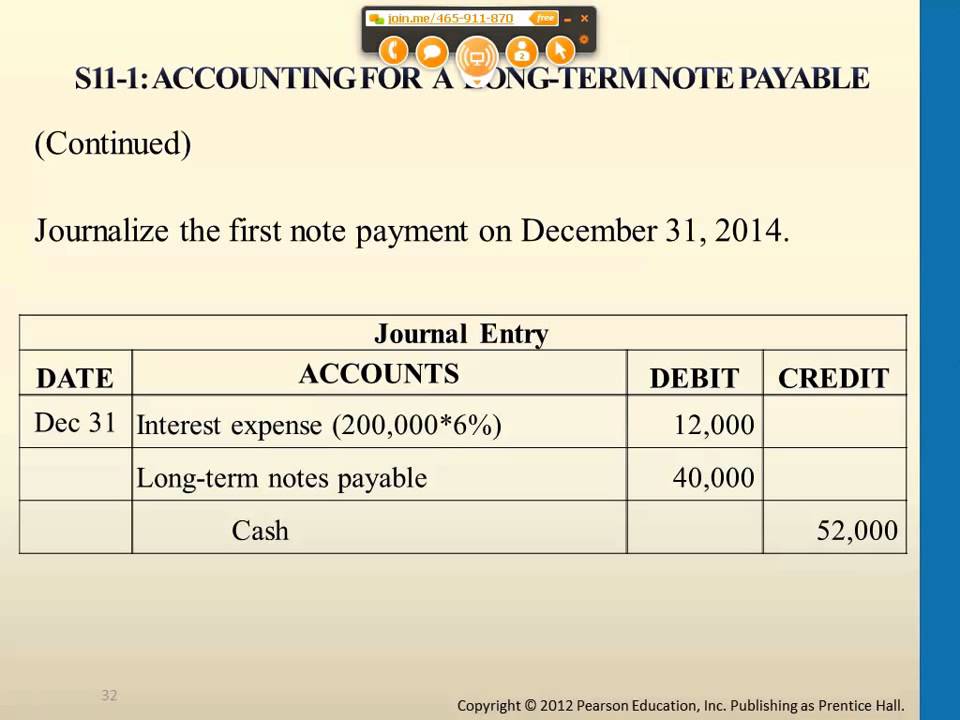

Accounting for a Long Term Note Payable YouTube

Contoh Wesel Tagih dan Wesel Bayar. Dijelaskan sebelumnya, perbedaan wesel tagih dan wesel bayar yang mendasar terletak pada pencatatannya. Wesel tagih (notes receivable) tercatat sebagai aset, sedangkan wesel bayar (notes payable) tercatat sebagai liabilitas.Contoh wesel tagih dan wesel bayar di bawah ini memperjelas perbedaan pencatatan keduanya.

Notes Payable That Are Due in Two Years Are

The promissory note is payable two years from the initial issue of the note, which is dated January 1, 2020, so the note would be due December 31, 2022. In addition, there is a 6% interest rate.

Gambar Contoh Slip Pembayaran Bukti Transaksi Perbankan Cek Perjalanan Biasa Digunakan di

Bagaimana Mencatat Jurnal Wesel Bayar (Notes Payable)? Berikut ini ada beberapa contoh mencatat jurnal wesel bayar dan wesel tagih yang bisa Anda pahami yaitu: Contoh Wesel Bayar Pertama. Dalam perusahaan mengeluarkan wesel 90 hari, di mana bunganya 10%. Dengan nilai Rp 2.000.000 pada tanggal 01 Juli 2020, untuk PT.

Notes Payable Learn How to Book NP on a Balance Sheet

Pada saat pelunasan Wesel Bayar (Note Payable) oleh Penerbit. Contoh : Pada tanggal 31 Agustus 2023 PT.Cahaya Unggul Abadi melunasi Wesel Bayar (Note Payable) kepada PT. Surya Agung Electric seharga Rp. 111.000.000 (seratus sebelas juta rupiah) dengan bunga 10 %.

How Debit Note Template Excel Format Helps You Having A Clear balance? Notes template, Debit

In notes payable accounting there are a number of journal entries needed to record the note payable itself, accrued interest, and finally the repayment. Suppose for example, a business issues a note payable for 15,000 due in 3 months at 8% simple interest in order to obtain a loan, then the total interest due at the end of the 3 months is.

Contoh Debit Note Invoice IMAGESEE

A: Cara Mencatat Jurnal Transaksi Wesel. Pada pembahasan topik ini, kita akan mengupas tuntas tentang pencatatan akuntansi wesel, pencatatan piutang wesel, dan jurnal penyesuaian wesel bayar (notes payable) dengan beberapa contoh transaksi pencatatan wesel termasuk contoh jurnal wesel tanpa bunga dan contoh soal pendiskontoan wesel.Sekaligus untuk menjawab dan menjelaskan beberapa pertanyaan.

Contoh Nota Kredit 12 Ciri Nota Debet Dan Kredit Beserta Penjelasannya Ilmu Ekonomi Zachary

Menerbitkan Wesel bayar 90 hari, bunga 10%. Anda melunasi pada saat jatuh tempo maka untuk menghitung bunganya Anda perlu mengkalkulasikan: = Rp 5.000.000 X 10% X (90/360) = Rp 125.000. Sehingga pencatatan keuangannya: Juni. 1.

Chapter Three Notes Payable YouTube

A single payment note payable, often used in short-term financing, involves a single lump-sum payment at the end of the loan term. This payment includes both the principal loan amount and the accrued interest. This type of transaction is typically recorded in the notes payable account and the cash account in the company's books. Amortized

Sample Note Payable On Demand Classles Democracy

Definition with examples. Notes payable are often used when a business borrows money from a lender like a bank, institution, or individual. Essentially, they're accounting entries on a balance sheet that show a company owes money to its financiers. Notes payable usually include the borrowed amount, interest rate, schedule for payment, and.

PPT Chapter 10 PowerPoint Presentation, free download ID1657867

Notes payable and accounts payable are both liability accounts that deal with borrowed funds. However, they are not synonymous. Again, you use notes payable to record details that specify details of a borrowed amount. With accounts payable, you use the account to record liabilities you owe to vendors (e.g., buy supplies from a vendor on credit).