Spread Nedir? Forex Spread Oranları Ne Kadar?

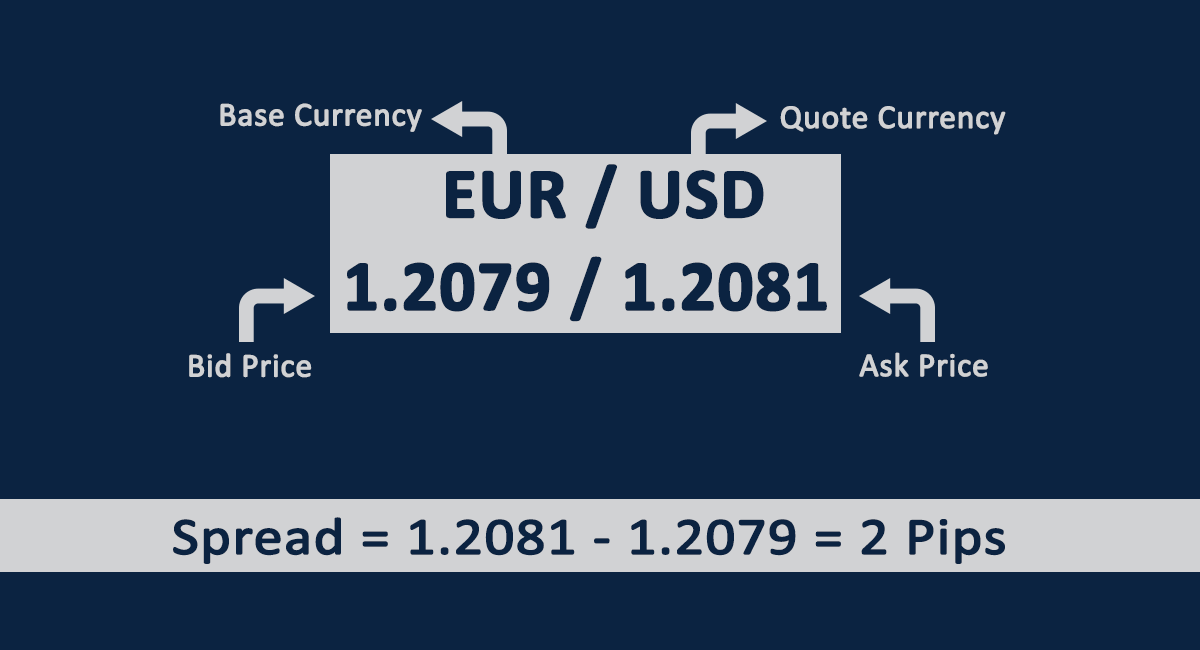

How to calculate a forex spread. To calculate a forex spread, all you need to do is subtract both bid and ask prices of a currency pair and the result will be the spread. Here are a few examples using popular currency pairs: If you are trading the EUR/USD at 1.1051/1.1053, the spread is: 1.1053-1.1051=0.0002 or 2 pips.

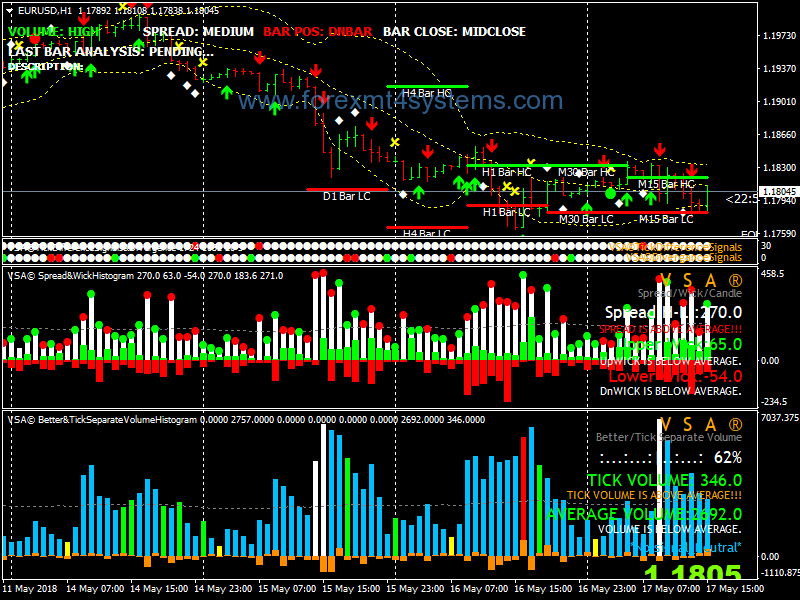

Understanding Forex Spreads Forex Volume Strategies

Example of calculating forex spread. Let's say the current ask price for a currency pair is 1.1000, and the bid price is 1.0990. Using our formula, we find the spread to be: Forex Spread = ((1.1000 - 1.0990) / 1.1000) x 100% ≈ 0.091%. Why you should calculate forex spread. Calculating the Forex spread is vital for several reasons:

Forex What Is The Spread Forex Robot Geeks

Historical forex spreads. Spreads are an inherent cost of trading. Rather than just viewing the minimum spread or current live spread we offer, you can use the OANDA spread tool to view minimums, averages and maximums that we have published on our trading platforms over the last few months. Create account Demo account.

What is A Forex Spread? Understanding Forex Spread BeoForex

The tighter the spread, the better value you get as a trader. For example: The bid price is 1.26739 and the ask price is 1.26749 for the GBP/USD currency pair. If you subtract 1.26739 from 1.26749, that equals 0.0001. As the spread is based on the last large number in the price quote, it equates to a spread of 1.0. Forex spread indicators

O Que é Spread Forex? Como Funciona o Spread Trading (2020) Admirals

Key Takeaways. The forex spread is the difference between a forex broker's sell rate and buy rate when exchanging or trading currencies. Spreads can be narrower or wider, depending on the currency.

How to Understand Forex Trading Spreads Howcast

Calculating Forex Spread. Forex spread is calculated by subtracting the bid price from the ask price. The resulting value is the spread in pips. For example, if the bid price of USD/JPY is 110.50 and the ask price is 110.55, the spread is 5 pips. Spread = Ask Price - Bid Price. In the example above, the spread can be calculated as follows:

What is a Spread in Forex? EA GROWING FOREX & GOLD (XAUUSD) TRADING

Live Forex Spreads. Forex brokers spread comparison in real time. Best spread is colored in green, worst spread is colored in red. For overall best spreads, look for the row colored mostly with green cells. Although spreads are a major factor in choosing a broker, they do not represent execution quality, slippage, or any other fees of a broker.

What Is Spread In Forex? Key Spread Trading Strategies

1. Choose The Currency Pair. The first step is to choose the currency pair you want to spread bet on first, most brokers offer 40 to 100 pairs to choose from. If you are a beginner, choosing one of the major forex pairs like EUR/USD or USD/JPY would be ideal as they have lower spreads and less volatile movements.

O Que é Spread Forex? Como Funciona o Spread Trading (2020) Admirals

That means as soon as our trade is open, a trader would incur 0.6 pips of spread. To find the total spread cost, we will now need to multiply this value by pip cost while considering the total.

Understanding Spread in Forex What It Is and what Moves It

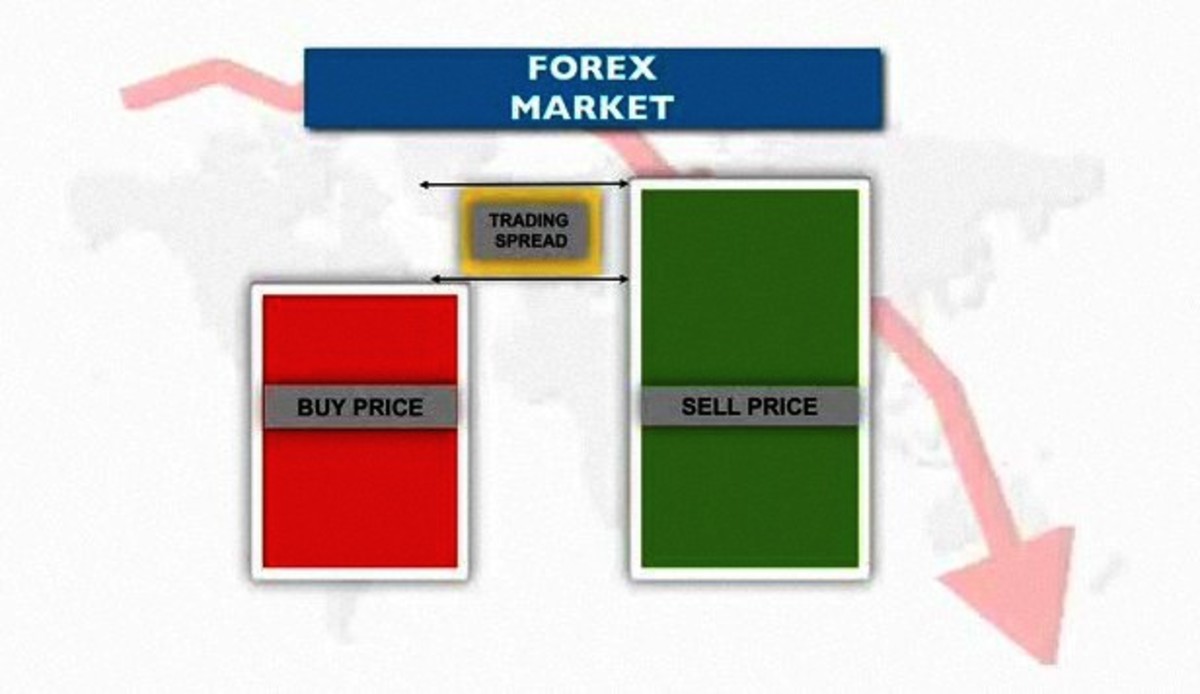

Forex Spread: An Introduction. In the Forex and other financial markets, the spread is the difference between the purchase price and the sale price of an asset. With online brokers, the purchase price is always higher than the sale price of an asset, meaning that if you opened a position and closed it straight away, you would make a loss.

Forex Spread What Does Spread Mean in Forex Get Know Trading

In forex trading, spreads are always expressed in pips, with a pip being 1/10,000th (0.0001) of a standard "lot." A "lot" consists of 100,000 units, so for an AUDUSD trade, a pip equates to USD $10 (0.0001 x 100,000). Suppose the average spread for AUDUSD is 0.821 pips (as per IC Markets); the spread cost amounts to USD $8.21 (0.821 x $10).

O que é o Spread no Forex? Saiba Como Funciona o Spread (2019)

Forex spreads, the difference between the bid and ask prices, directly impact the costs associated with executing trades. As a trader, it is important to be able to accurately calculate the spread costs and interpret their implications for your trading strategies and profitability. Calculating Forex Spreads

Binary Options DX Trade C4 Nitro Forex System YouTube

This is usually 1/10th of a pip, so for instance, a 3 spread would mean a spread that is 0.3 pips wide, while a 24 spread would indicate a spread that is 2.4 pips wide. You can always check to see what digits are applicable for the currency pair you wish to trade.

En Düşük Spread Veren Forex Firmaları Forex Spread Oranları

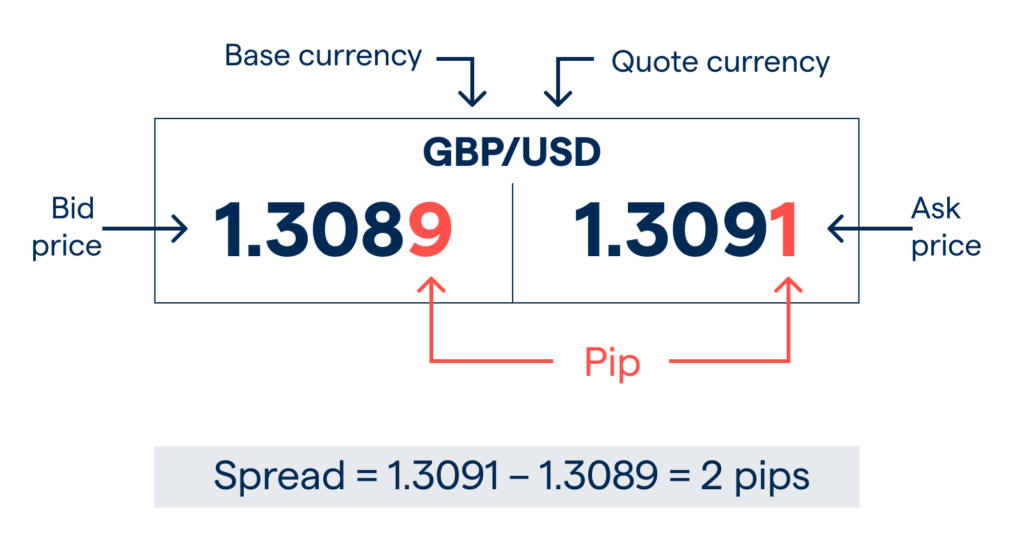

To calculate the spread in forex, you have to work out the difference between the buy and the sell price in pips. You do this by subtracting the bid price from the ask price. For example, if you're trading GBP/USD at 1.3089/1.3091, the spread is calculated as 1.3091 - 1.3089, which is 0.0002 (2 pips). Spreads can either be wide (high) or.

What is Forex Spread

The spread is one of the most important concepts to understand when it comes to trading Forex because it can make a significant difference to your bottom line. Most Forex brokers will make their profit via the spread. Think of the spread as the price that you pay for your Forex transaction. To further push that point, consider that if a broker.

Spread in Forex Explained Definition & Examples

There are two main types of spreads in forex trading: fixed spreads and variable spreads. 1. Fixed Spreads: As the name suggests, fixed spreads remain constant regardless of market conditions. This means that the difference between the bid and ask price remains the same regardless of volatility. Fixed spreads are typically offered by market.