E0 B8 9b E0 B8 81 E0 B8 84 E0 B8 B2 E0 B9 80 E0 B8 9f E0 B9 88 E0 B8 Free Download Nude Photo

Leverage adjustments under different margin modes. By default, positions are opened using Cross Margin mode, and the leverage can be adjusted under both Isolated and Cross Margin modes. After the adjustment, the position margin will be recalculated, please pay attention to the change in liquidation price.

The crosscorrelation coefficient and (b) crosscorrelation gain versus... Download Scientific

Provided User A traded in cross margin mode while User B traded in isolated margin mode. (Trading fees and interest are not considered in this example). DAY ONE. User A (Cross Margin) User B (Isolated Margin) Assets. 5 ETH. 5 BCH. 5 ETH. 5 BCH. Collateral. 400 USDT. 200 USDT. 200 USDT. Margin Level (5 ETH * 200 + 5 BCH * 200) / 1600 = 1.25 (5.

Cross margin traders can further limit their potential losses by setting a stop loss at appropriate levels. Cross Margin Example. Another example shows why cross margin is the best choice for traders.

Translational activity and machinery in rice seed tissues. (AC)... Download Scientific Diagram

In other words, the cross margin mode is to put all the eggs in one basket, while the isolated margin mode is to spread the eggs into multiple baskets. The isolated margin mode is generally more suitable for short-term investors or novice users who are new to contract trading. Through position and margin segregation, potential losses are.

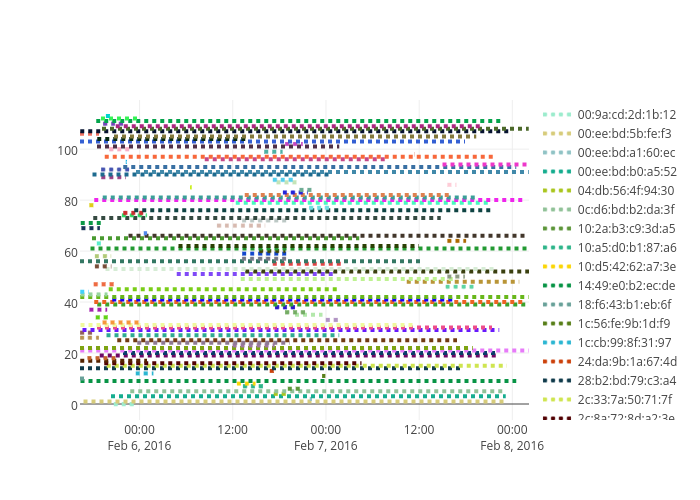

009acd2d1b12, 00eebd5bfef3, 00eebda160ec, 00eebdb0a552, 04db564f9430

Under Isolated mode: Unrealized P&L% = Unrealized P&L / (initial margin + fee to close + additional margin added to position) x 100%. Under Cross margin mode: Unrealized P&L% = Unrealized P&L / (initial margin + fee to close) X 100%. An increase in leverage will reduce the initial margin required or vice versa.

a) T1u TOi Γ15 modes in α‐CsPbI3 propagating along a. b) Imaginary TO... Download Scientific

Cross Margin. In Cross Margin mode, the entire available balance is automatically utilized to prevent liquidations. The funds in your available balance are shared across multiple positions under the same trading account. Users do not need to manually allocate funds to maintain minimum margin requirements. Instead, the Phemex crypto trading.

Crosscontrol of polarization and Prior to the... Download Scientific Diagram

Let's see how to select a margin mode on the Binance website. 1. Log in to your Binance website and go to [Trade] - [Trading Bots]. Select [Futures Grid] and a symbol to trade. 2. Enter the price range, number of grids, and investment margin. 3. Expand the [Advanced (Optional)] section and click [Cross]. 4.

Article 6 E0 B8 81 E0 B8 B2 E0 B8 A3 E0 B9 80 Free Download Nude Photo Gallery

2020-06-04 13:23. You can trade in Isolated Margin and Cross Margin modes on Binance Margin. With the Isolated Margin mode, you can allocate a specific amount of margin to a single position to limit risks. In contrast, the Cross Margin mode uses the balance of your entire Margin Account as collateral, providing you with greater flexibility and.

e0b899e0b989e0b8b3e0b895e0b881e0b8a3e0b989e0b8ade0b899e0b884e0b8

On DueDEX, Cross Margin mode is set as default. You can switch to Isolated Margin by using the leverage slider on the right side of the Trade Dashboard. (see picture below) The leftmost mode is.

E0 B8 9a E0 B9 89 E0 B8 B2 E0 B8 99 E0 B8 9e E0 B8 B8 E0 B8 99 E0 B9 Free Download Nude Photo

Isolated margin and cross margin are two different margin types available on many cryptocurrency trading platforms. Each mode has its own utility and risks. Let's understand what they are and how they work. In isolated margin mode, the amount of margin is limited to a specific position. This means that you decide how much of your funds you.

e0b89ee0b8b7e0b989e0b899e0b897e0b8b5e0b988e0b8aae0b8b5e0b981e0b8

When engaging in margin trading on LBank, you need to choose between the two margin modes: Cross Margin and Isolated Margin. Cross Margin Mode. Cross Margin Mode is a margin setting where a single margin balance is shared among all your open positions. This means that the entire margin balance acts as collateral for all your active trades.

The most commonly-used margin mode across exchanges is called cross margin. In this mode, your entire account balance is used to margin all open positions. The good part about cross margin is that P&L from one position can be used to support a position that is close to liquidation. Depending on the platform, this works with unrealized P&L too.

Optical characterization of the CM/PCS hybrid (T3). (a, b) Reflection... Download Scientific

How to Use the Isolated Margin Mode on Binance. 2020-06-28 05:40. Website. App. Website. 1.. Please note that you must repay using the same coin you borrowed for your Cross/Isolated Margin trading. For example, if you borrow 10 BTC, you need to repay 10 BTC (plus interest).

E0 B8 9b E0 B8 81 E0 B9 80 E0 B8 84 E0 B9 80 E0 B8 Ad E0 B9 83 E0 B8 Free Nude Porn Photos

Keep reading to learn the benefits of margin trading and the difference between isolated vs cross margin trading and how to use one of these to prevent the liquidation of every single position. Margin Trading: An Overview.. In isolated margin mode, the maintenance margin needed for 100:1 leverage is just 1% away from the price you opened.

การบวกลบปริมาณที่มีความคลาดเคลื่อน ฟิสิกส์วันละนิด EP.6 YouTube

Binance Margin Trading has recently launched isolated margin mode, alongside its existing cross margin mode. You may select Cross 5x or Isolated 5x on the new trading page, as shown below. In isolated margin mode, the margin is independent in each trading pair:. Each trading pair has an independent isolated margin account.

Tbeam crosssection (E = λE E0) [m] (left). Relative error decay vs.... Download Scientific

A main difference is the type of margins used by exchanges - isolated and cross margins are the common ones. Let's get into what these two mean. Before we discuss the different types of margins, let's briefly review what margin is. Let's say David has $2000 of his own funds as collateral for a leveraged position, this is what we refer.