What Is Asset Turnover Ratio? It Business mind

Nah, itulah penjelasan terkait pengertian dan rumus total asset turnover. Total asset turnover adalah salah satu rasio aktivitas yang penting bagi investor ketika memilih sebuah saham perusahaan. Selain saham, belakangan ini investasi crypto sedang banyak diminati masyarakat Indonesia. Wajar saja, harga the Sandbox, salah satu aset crypto.

Asset Turnover Ratio Definisi, Rumus dan Contoh Perhitungan InvestBro

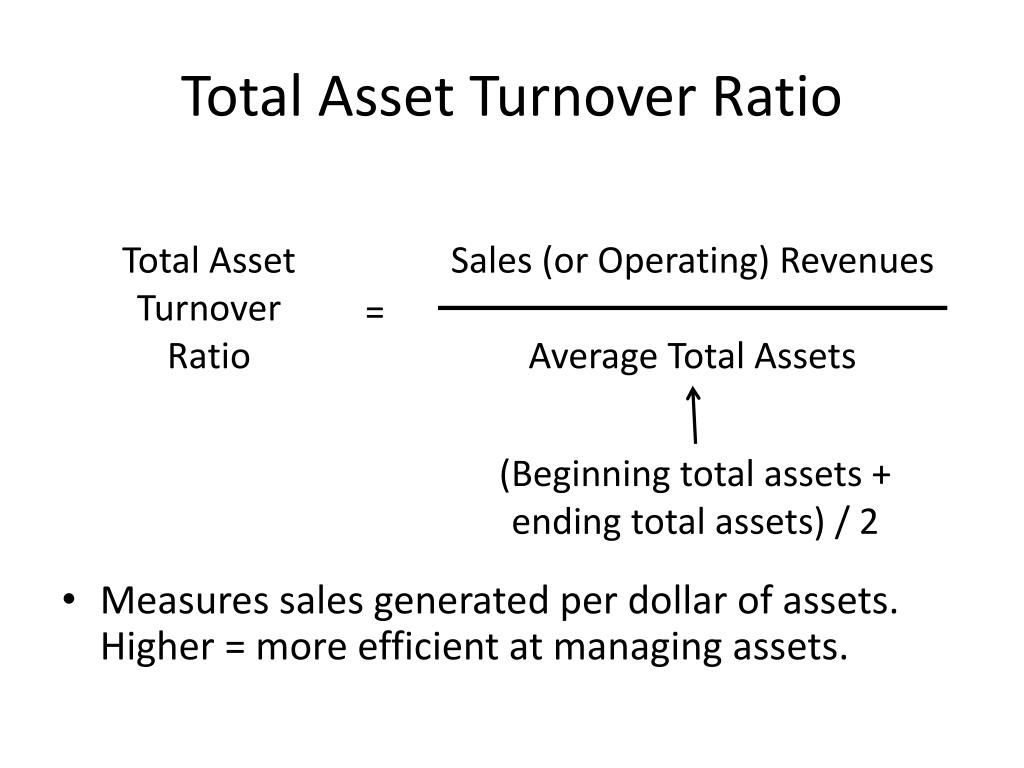

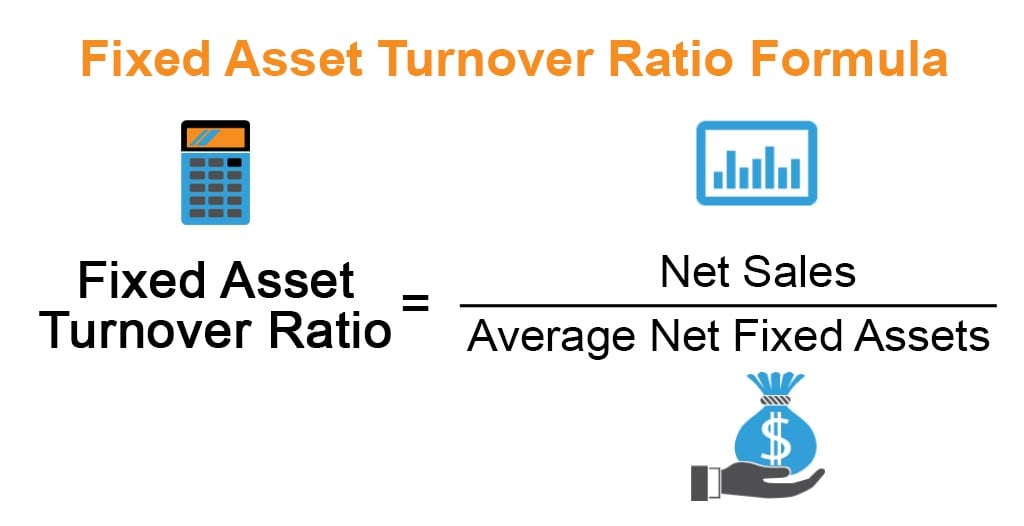

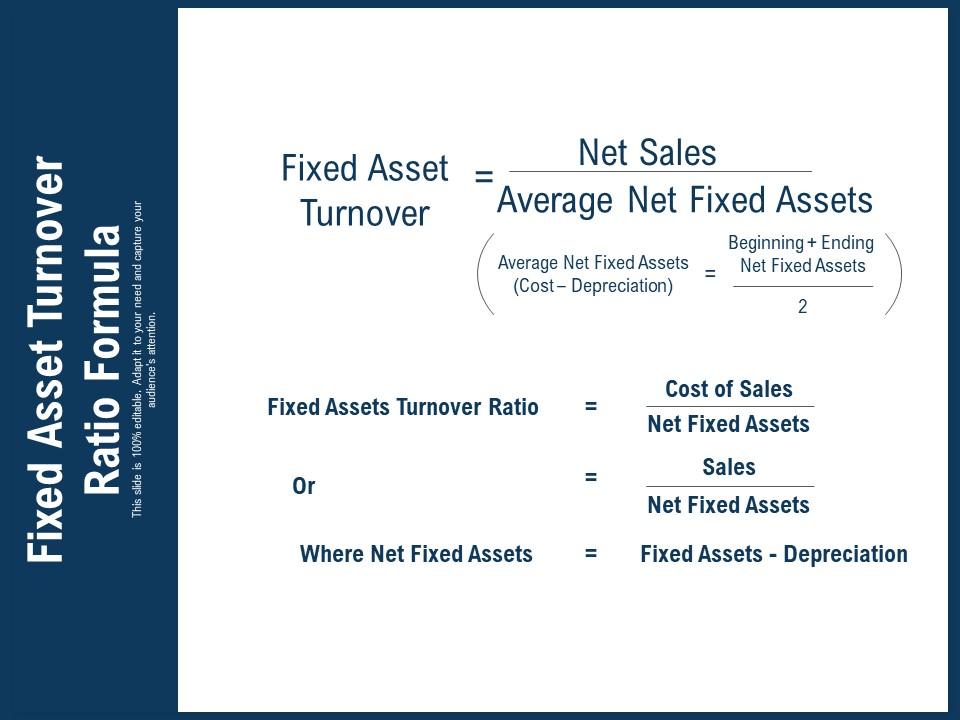

Total Assets include both fixed assets and current assets. Example. Assume that a company has $1.2 million in sales for the year. Its average current assets were $700,000, and average fixed assets were $1,000,000. The fixed asset turnover ratio will be $1,200,000/$700,000 = 1.71. The total asset turnover ratio will be $1,200,000/($700,000.

Asset Turnover Ratio Plan Projections

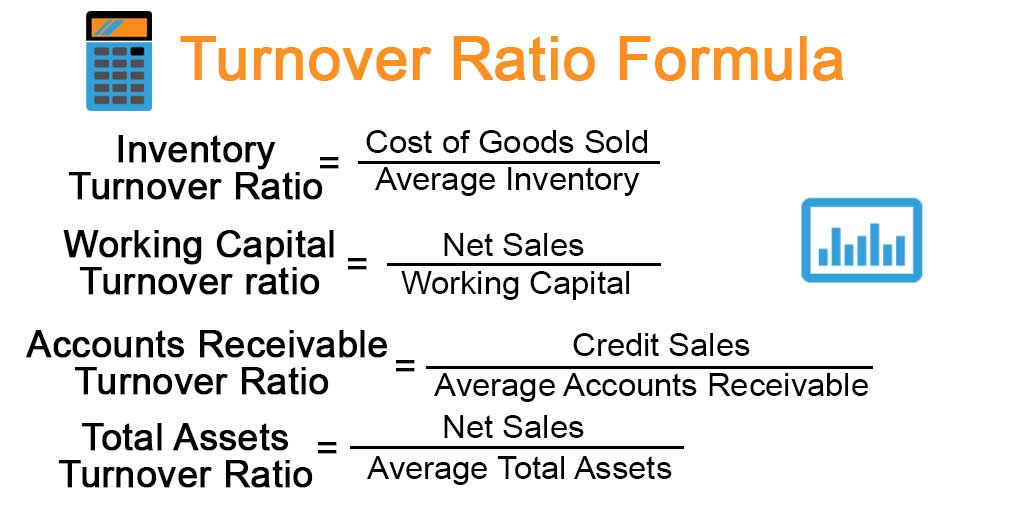

How to Calculate the Total Asset Turnover Ratio. The formula for total asset turnover can be derived from information on an entity's income statement and balance sheet. The calculation is as follows: Net sales ÷ Total assets = Total asset turnover. It is best to plot the ratio on a trend line, to spot significant changes over time.

How to Calculate the Asset Turnover Ratio. Overview and Explanation

Rumus Asset Turnover Ratio. Rumus untuk menghitung nilai asset turnover sebenarnya sangat sederhana. Dimana rumusnya adalah: Asset Turnover Ratio = Total Penjualan / {(Aset Awal + Aset Akhir)/2) Pertama, Anda harus mengetahui total penjualan yang perusahaan Anda peroleh dalam periode atau kurun waktu tertentu. Setelahnya, Anda perlu mengetahui.

Total asset turnover ratio formula calculator monright

Formula for Asset Turnover Ratio. The formula for the asset turnover ratio is as follows: Where: Net sales are the amount of revenue generated after deducting sales returns, sales discounts, and sales allowances.; Average total assets is the average of total assets at year-end of the current and preceding fiscal year. Note: an analyst may use either average or end-of-period assets.

Fixed Asset Turnover Ratio Formula Calculator, Example Excel Template

This tutorial will cover the concept of Asset Turnover Ratio from the ground up, including its formula and step-by-step calculations. Following that, we will.

:max_bytes(150000):strip_icc()/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

Asset Turnover Ratio Definition Formula & Examples

Sebaliknya, asset turnover ratio yang rendah berarti kinerja aset belum efisien untuk menghasilkan penjualan bersih. Rumus asset turnover ratio dihitung dengan membagi net sales perusahaan dengan total assets dalam periode tertentu. Cara menghitung ATR akan lebih mudah dipahami dengan contoh soal ATR yang telah dibahas sebelumnya.

Turnover Ratio Formula Example with Excel Template

So to calculate the average total assets, we need to take the average of the figure at the beginning of the year and of the figure at the end of the year, i.e. (US$ 236.60 billion + US$219.30 billion)/2 = US$228.1 billion. Then the asset turnover of Wal-Mart would be precisely (US $523.96 billion / US$228.1 billion) = 2.29x.

Total Assets Turnover Ratio YouTube

The total asset turnover formula is shown below: total asset turnover = revenue / average assets. Hence, the total asset turnover for Company Alpha is $10,000,000 / $8,500,000 = 1.18x. Still, you don't need to know how to find total asset turnover in detail if you use our asset turnover ratio calculator!

Asset Turnover Ratio Formula & Examples AwesomeFinTech Blog

Total Asset Turnover Calculation Example. We now have all the required inputs, so we'll take the net sales for the current period and divide it by the average asset balance of the prior and current periods. To calculate the ratio in Year 1, we'll divide Year 1 sales ($300m) by the average between the Year 0 and Year 1 total asset balances.

Fixed Asset Turnover Ratio Formula PowerPoint Shapes PowerPoint Slide Deck Template

Total Asset Turnover metrics can provide an indication of how efficiently a company is using its resources, making it a valuable measure in the context of CSR. H3 Sustainability through Efficient Resource Use. Furthermore, the concept of sustainability is closely tied to that of resource use efficiency. Organizations can demonstrate their.

Asset Turnover Ratio Formula + Calculator

The asset turnover ratio is calculated by dividing net sales by average total assets. Net sales, found on the income statement, are used to calculate this ratio returns and refunds must be backed out of total sales to measure the truly measure the firm's assets' ability to generate sales. Average total assets are usually calculated by.

Asset Turnover Ratio Formula and Calculations Financial

Fixed Asset Turnover (FAT) is an efficiency ratio that indicates how well or efficiently a business uses fixed assets to generate sales. This ratio divides net sales by net fixed assets, calculated over an annual period. The net fixed assets include the amount of property, plant, and equipment, less the accumulated depreciation.

How to Calculate the Total Asset Turnover 7 Steps (with Pictures)

perusahaan. Menurut Hartono (2017, 282) rumus untuk mengukur ukuran perusahaan menggunakan total aset adalah: Ukuran Perusahaan = Ln Total Aset (Destari & Hendratno, 2019). Menurut Brigham dan Houston (2010: 4) dalam (Mahmudin, Lau, &. Total Assets Turnover, Receivable Turnover, 3) Inventory Turnover, 4) Working Capital Turnover, dan 5).

Asset Turnover Ratio Arti, Manfaat, Rumus, dan Contoh Perhitungannya

Berikut ini adalah Rumus Rasio Perputaran Total Aset (Total Asset Turnover Ratio). Rasio Perputaran Total Aset = Penjualan / Rata-rata Total Aset Catatan : Rata-rata Total Aset biasanya dihitung dengan menambahkan saldo aset awal dan akhir kemudian dibagi menjadi dua sehingga Rumus Rasio Perputaran Total Aset juga dapat ditulis seperti dibawah.

Asset Turnover Ratio Formula & Examples Video & Lesson Transcript

Asset Turnover Ratio = Net Sales / Average Total Assets. Net sales is the total amount of revenue retained by a company. It is the gross sales from a specific period less returns, allowances, or.