Present Value Interest Factor Table PDF Mathematical And Quantitative Methods (Economics

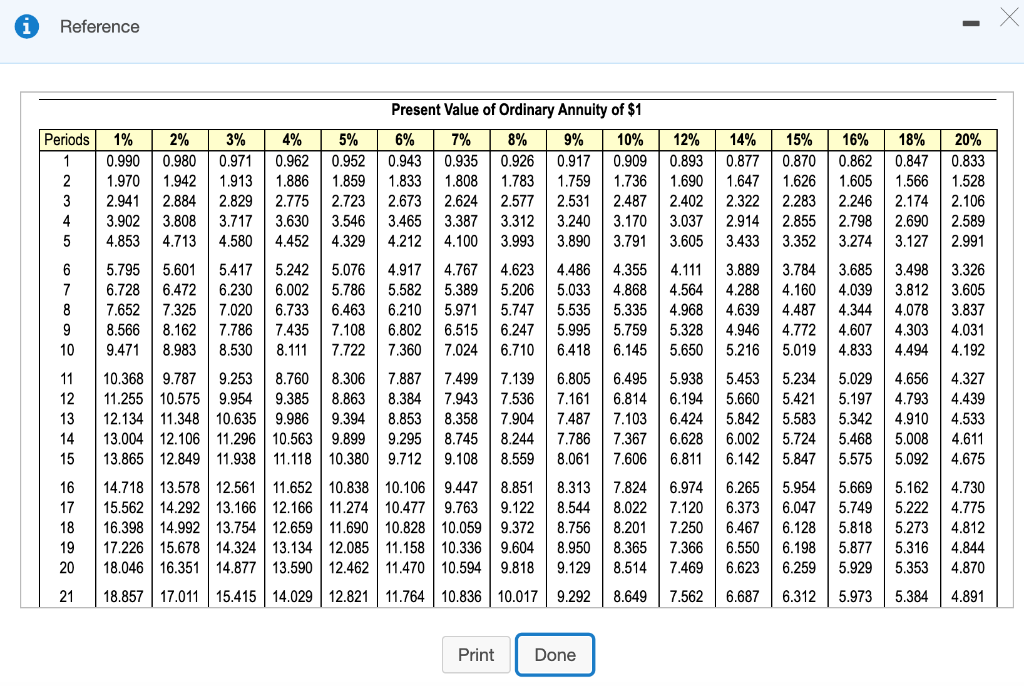

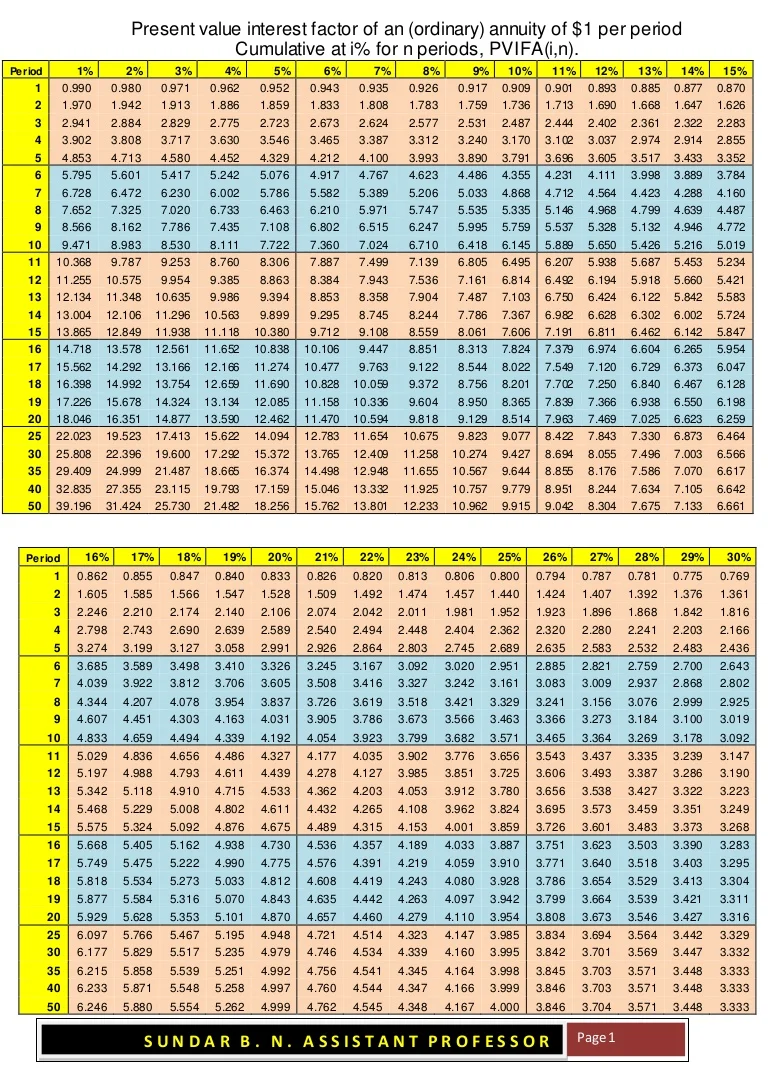

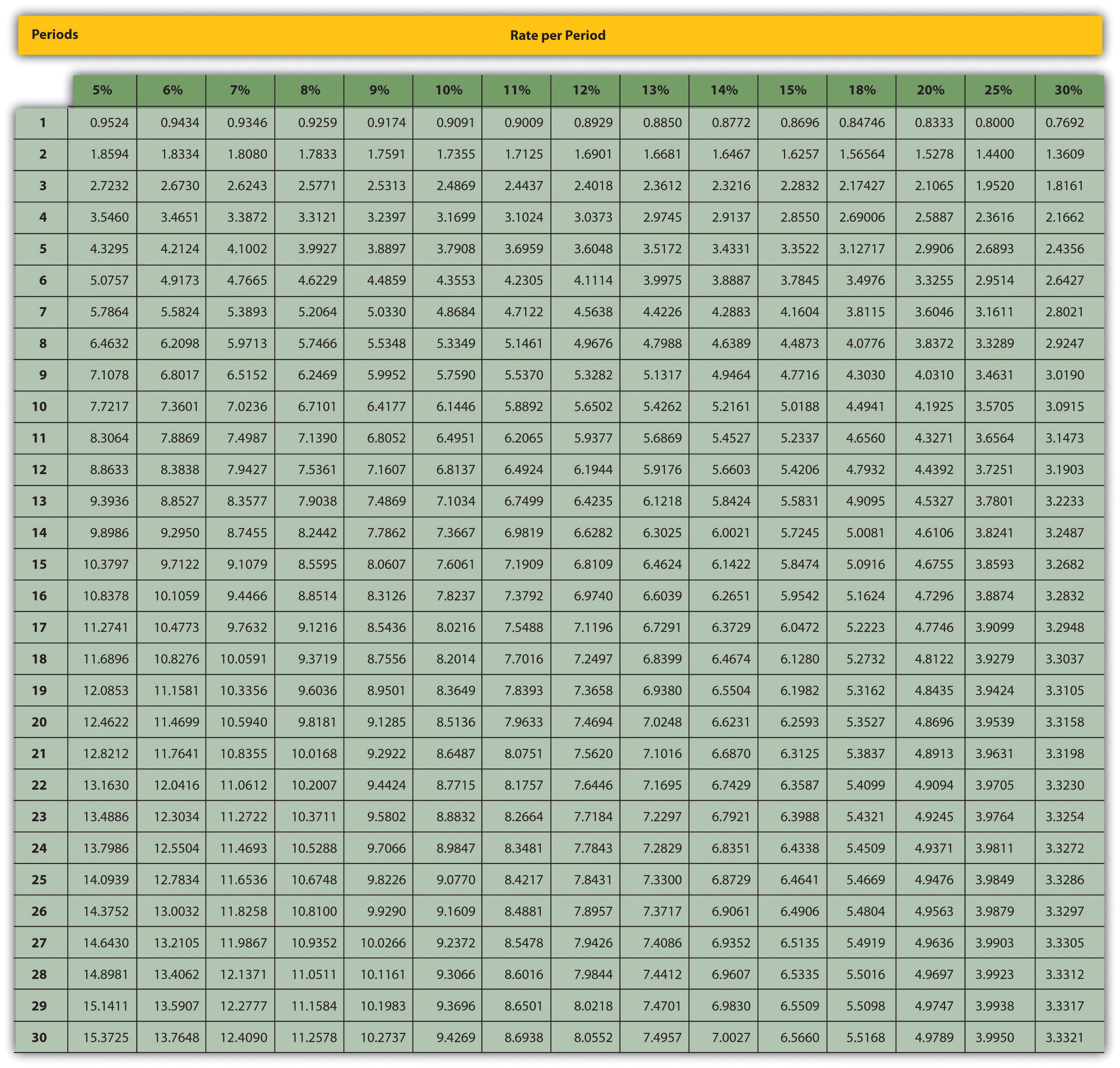

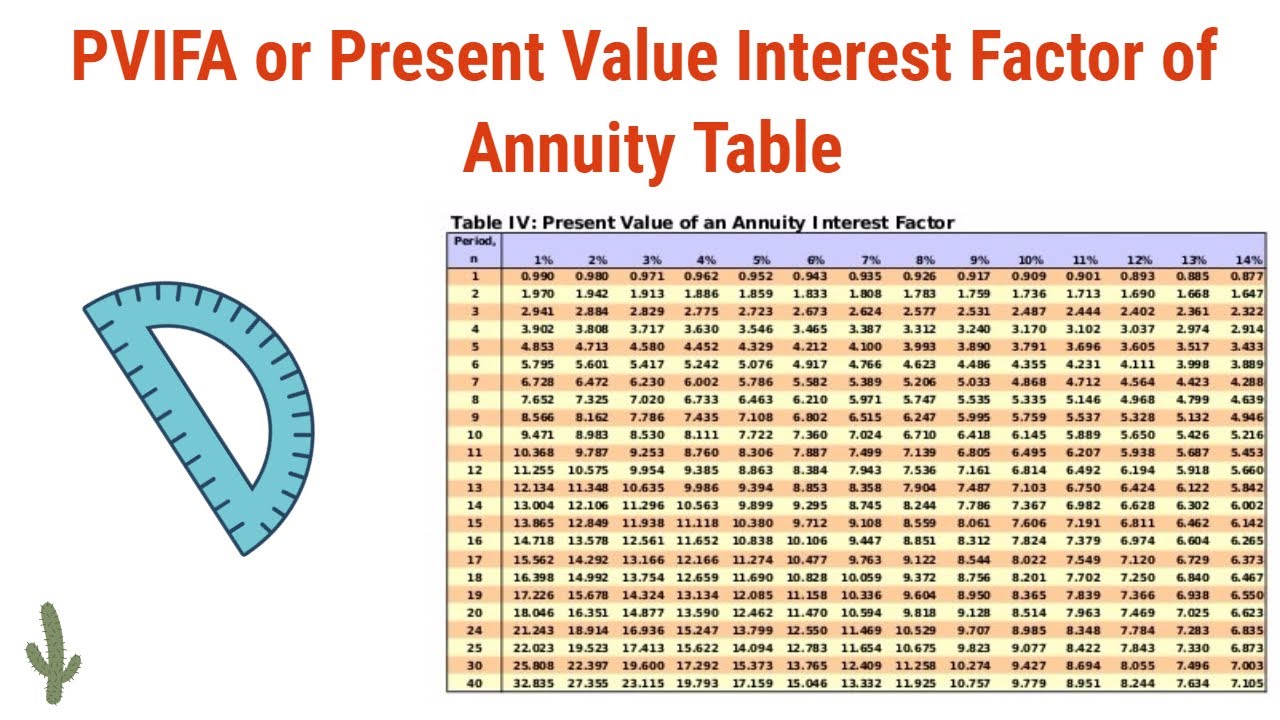

Annuity Table: A method for determining the present value of a structured series of payments. The annuity table provides a factor, based on time and a discount rate , by which an annuity payment.

Present Value (Interest) Factor Tables What are they and how to use them YouTube

8.1107. 7.7219. PVIFA Formula example: Consider an example when a person is investing in an annuity with an interest rate of 2% per year. He receives a total of 9 annual payments. The present value interest factor of the annuity can be calculated from the PVIFA formula, PVIFA = {1- (1+r) -n }/r. Hence the value will be, PVIFA = {1- (1+2) -9 }/2.

Present Value Interest Factor Table Pdf Elcho Table

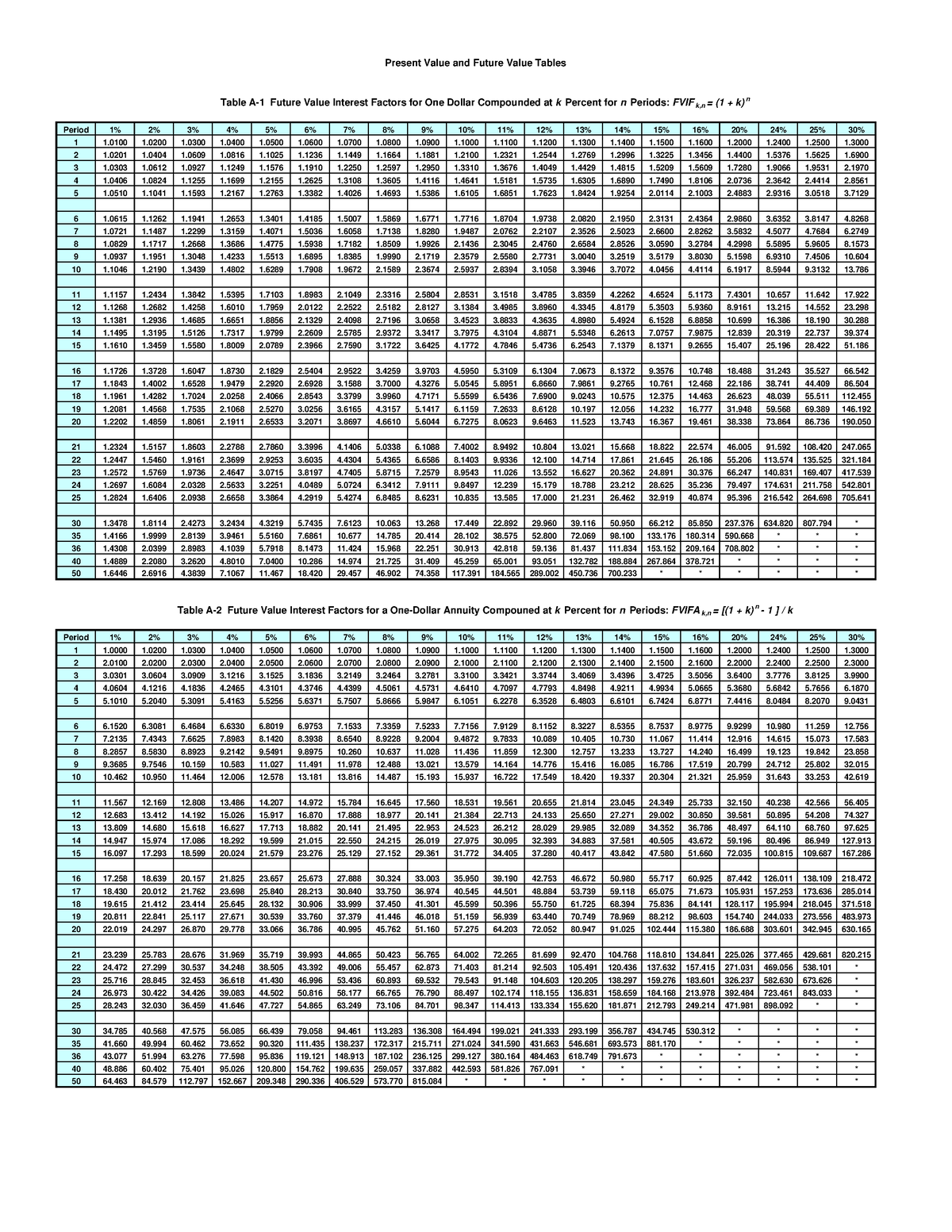

Future Value Tables. The purpose of the future value tables or FV tables is to carry out future value calculations without the use of a financial calculator. They provide the value at the end of period n of 1 received now at a discount rate of i%. The future value formula is: FV = PV x (1 + i)n. Future value tables provide a solution for the.

Appendix Present Value Tables Accounting for Managers Course Hero

The factor used to calculate present value of series of annuity payments known as Present Value Interest Factor of annuity (PVIFA). Along with this, it is a number through which the present value of a series of payment is represented. With the help of it, the initial payment becomes able to earn interest at the periodic rate (r) over a number.

What is an Annuity? Present Value Formula + Calculator

The present value interest factor of an annuity is the discount rate used to determine how much an annuity is worth today. This is an adjusted rate to account for future risk. Remember, annuities (typically) are perpetual payments that begin at a predetermined point in time after the initial investor has made a lump sum payment.

Tabel keuangan1 Present Value and Future Value Tables Table A1 Future Value Interest Factors

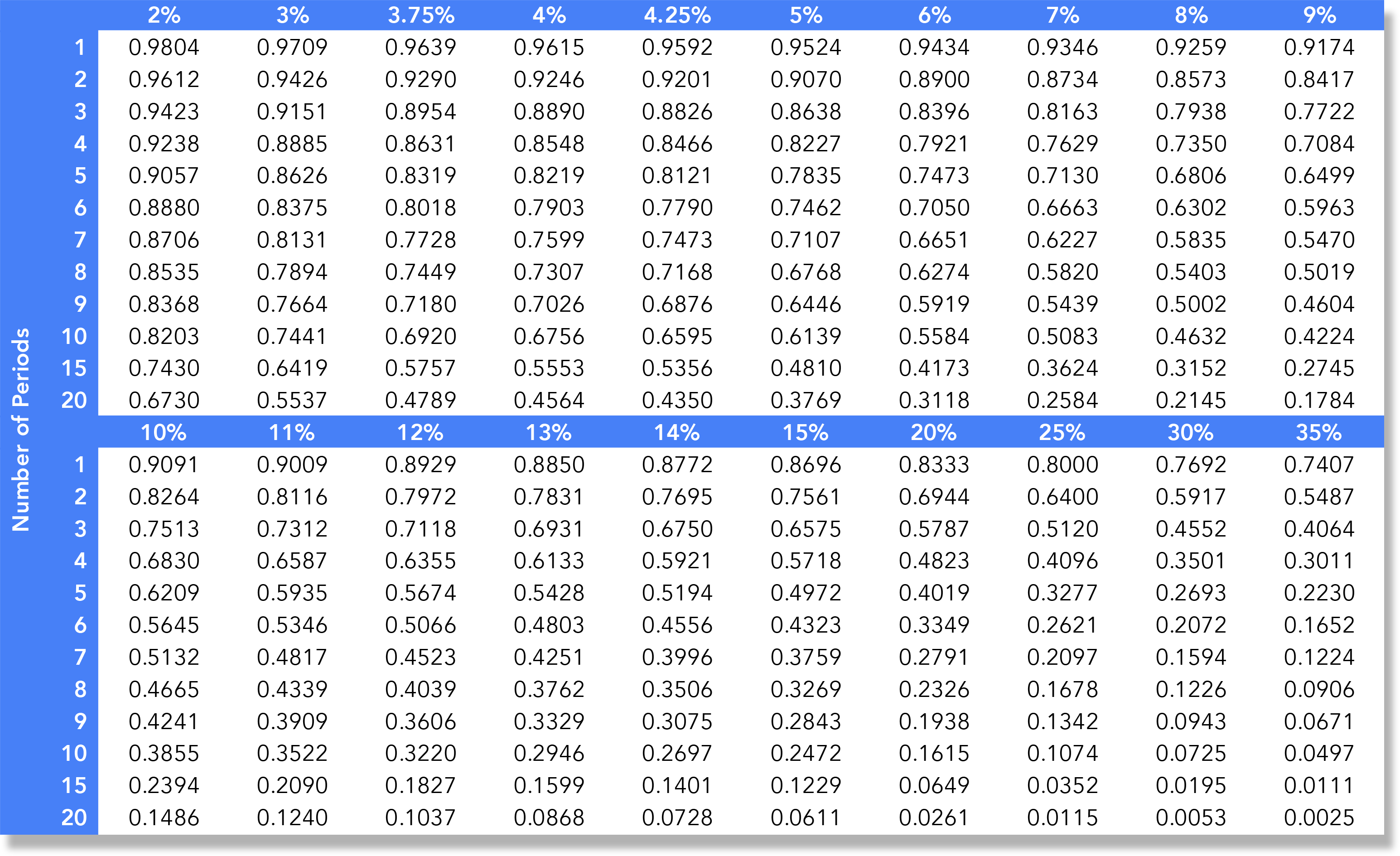

The formula for Present Value Interest Factor is: PVIF = 1 / (1+r)n . r = discount rate or the interest rate. n = number of time periods. The above formula will calculate the present value interest factor, which you can then use to multiply by your future sum to be received. 3.

Issuing a Bond Wize University Introduction to Financial Accounting Textbook Wizeprep

TABLE AI.1 Future Value of $1 Interest Rate 506. TABLE AI.2 Future Value of an Annuity of $1 Interest Rate 507. TABLE AI.3 Present Value of $1 Interest Rate 508. TABLE AI.4 Present Value of an Annuity of $1 Interest Rate 509. Title. Appendix I: Future and Present Value Tables. Created Date. 3/5/2012 10:25:26 AM.

62 TABEL BUNGA PRESENT VALUE INTEREST FACTOR TABEL

To calculate PVIFA (present value interest factor of annuity), you can use these simple steps: Sum 1 and the decimal interest rate r per period. Elevate the result to the -n th power, where n is the number of compound periods. Subtract the result of point 2. from 1. Divide by r.

Present Value Interest Factor Annuity Table Pdf

The PVIFA Calculator is used to calculate the present value interest factor of annuity (abbreviated as PVIFA). PVIFA is a factor that can be used to calculate the present value of a series of annuities. PVIFA Formula. The PVIFA calculation formula is as follows:

Present Value Of Annuity Table Up To 50 HEWQB

The PVIF calculation formula is as follows: PVIF = 1 / (1 + r) n. Where: PVIF = present value interest factor. r = interest rate per period. n = number of periods.

(PDF) TABLE A2 Present Value Interest Factors for One Dollar Discounted at i Percent for n

COMPOUND INTEREST TABLES 277 TABLE C.2 0.50% Compound Interest Factors 0.50% Single Payment Uniform Payment Series Compound Present Sinking Capital Compound Present Amount Worth Fund Recovery Amount Worth n Factor Factor Factor Factor Factor Factor n Find F Find P Find A Find A Find F Find P given P given F given F given P given A given A

Solved Interest rates determine the present value of future

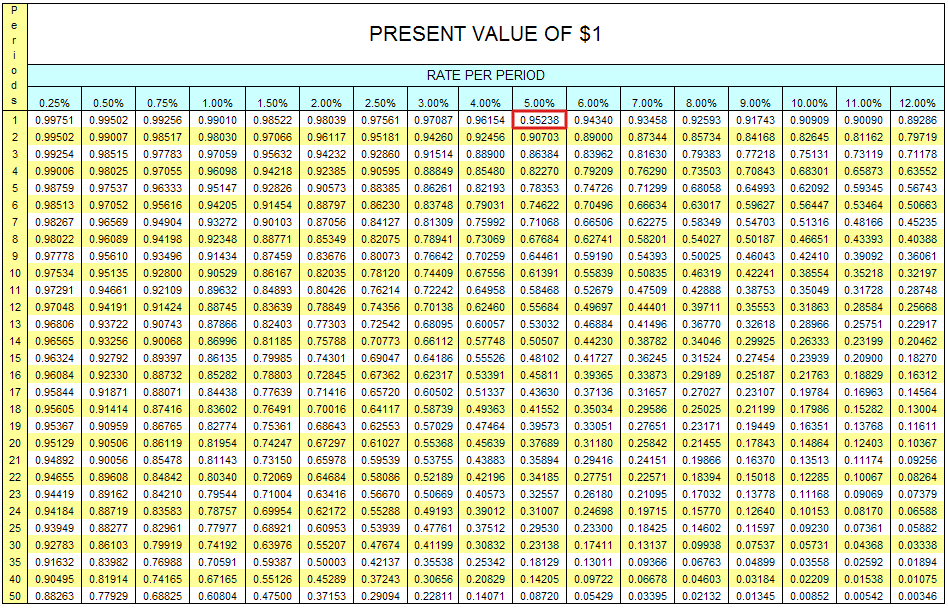

The present value formula is: PV = FV / (1 + i) n. This can be re written as: PV = FV x 1 / (1 + i) n. PV tables are used to provide a solution for the part of the present value formula shown in red, this is sometimes referred to as the present value factor. PV = FV x Present value factor PV Tables Example

Present Value Interest Factor of an Annuity of 1 Per Period Cumulati…

Present and Future Value Tables This table shows the future value of $1 at various interest rates ( i) and time periods ( n). It is used to calculate the future value of any single amount. TABLE 1 Future Value of $1 FV = $1 (1 + i ) n n / i

Appendix Present Value Tables

Calculator Use. PVIF calculator to create a printable present value of $1 table. Present value is calculated from the formula. PV = FV (1 + i)n ⇒ PV = $1 (1 + i)n P V = F V ( 1 + i) n ⇒ P V = $ 1 ( 1 + i) n. where PV is the present value, FV is the future value = $1, i is the interest rate in decimal form and n is the period number.

Present Value Interest Factor Annuity Table Pdf Bruin Blog

PVIF Calculator is an online tool used to calculate PVIF or Present Value Interest Factor of a single dollar, rupee, etc. PVIF is used to determine the future discounted rate of a selected value as well as the current value of a particular series for a set number of periods. Checkout the PV Table below which shows PVIFs for rates from 0.25% to 20% and periods from 1 to 50.

Free Financial Market Education Future Value and Present Value Methods

The formula for calculating the present value of an ordinary annuity is: P = PMT [ (1 - (1 / (1 + r)n)) / r] Where: P = The present value of the annuity stream to be paid in the future. PMT = The amount of each annuity payment. r = The interest rate. n = The number of periods over which payments are made. An annuity table is used to determine.