Withholding Tax WHT with effective from 20180401 YouTube

WHT (Withholding Tax) artinya Pajak yang dipungut oleh pihak ketiga. Pihak ketiga dalam hal ini adalah pemberi penghasilan, Pihak pertama dan kedua dalam hal ini adalah Fiskus (Kantor Pajak) dan Penerima Penghasilan. WHT terdiri dari PPh 21, PPh 22, PPh 23, PPh 26, PPh 4 ayat 2. Contoh PT. A memberikan Jasa Maintenance kepada PT.B .

[AccRevo Platform บัญชีดิจิทัล] 📈 EWithholding Tax มาติดตามดูว่า E Witholding Tax ทำงานกัน

Withholding tax is an amount withheld by the party making payment (payer) on income earned by a non-resident (payee) and paid to the Inland Revenue Board of Malaysia. 'Payer' refers to an individual/body other than individual carrying on a business in Malaysia. He is required to withhold tax on payments for services rendered/technical advice.

Withholding Tax (WHT) GRA

t. e. Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment.

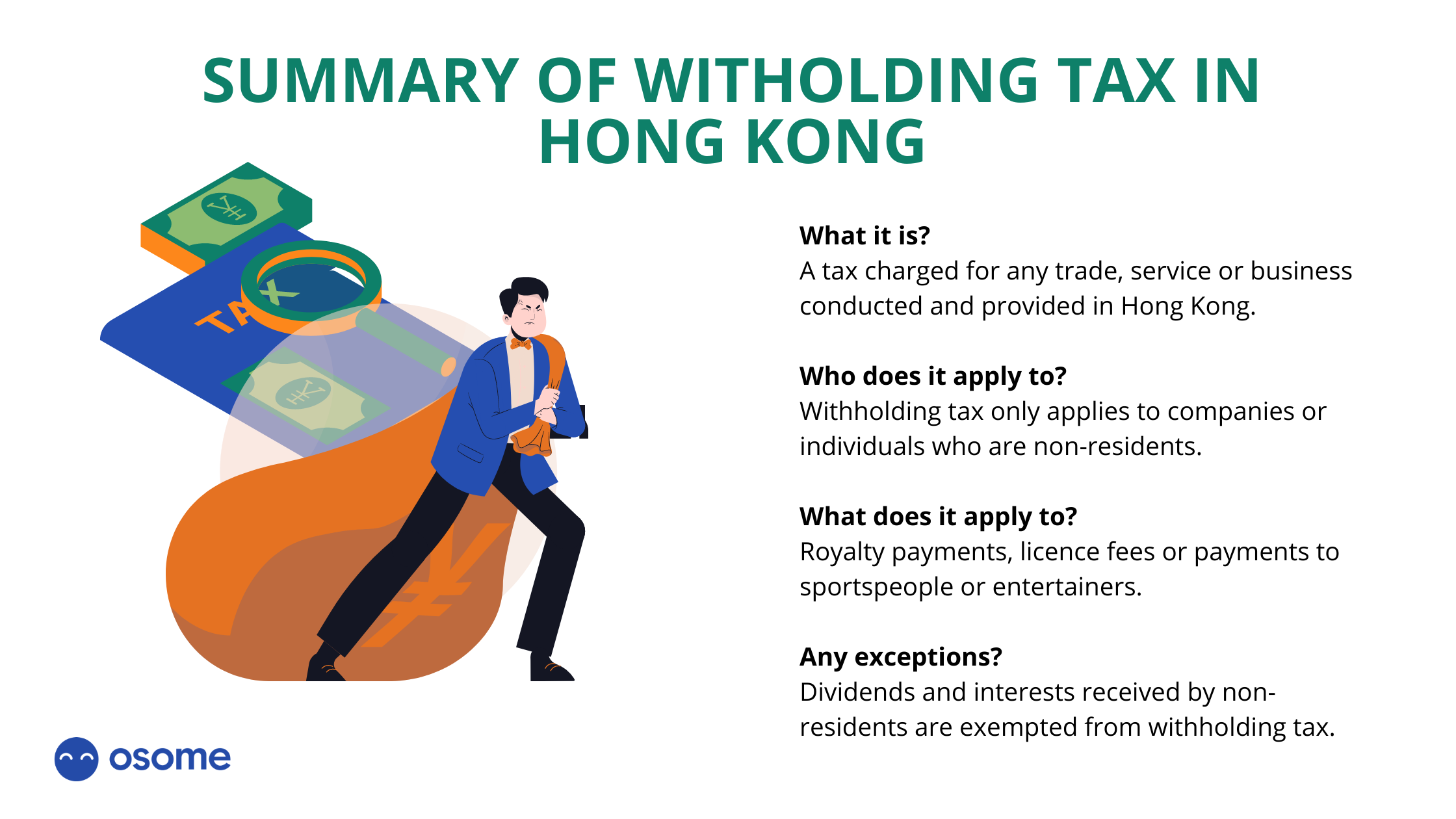

All You Need to Know About Withholding Tax in Hong Kong

The Tax Withholding Estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. We don't save or record the information you enter in the estimator. For details on how to protect yourself from scams, see Tax Scams/Consumer Alerts. Check your W-4 tax withholding with the IRS Tax.

Should advertisers pay Withholding Tax on Google & Facebook advertising in Malaysia? ecInsider

Corporate - Withholding taxes. Last reviewed - 07 February 2024. Under US domestic tax laws, a foreign person generally is subject to 30% US tax on the gross amount of certain US-source income. All persons ('withholding agents') making US-source fixed, determinable, annual, or periodical (FDAP) payments to foreign persons generally must report.

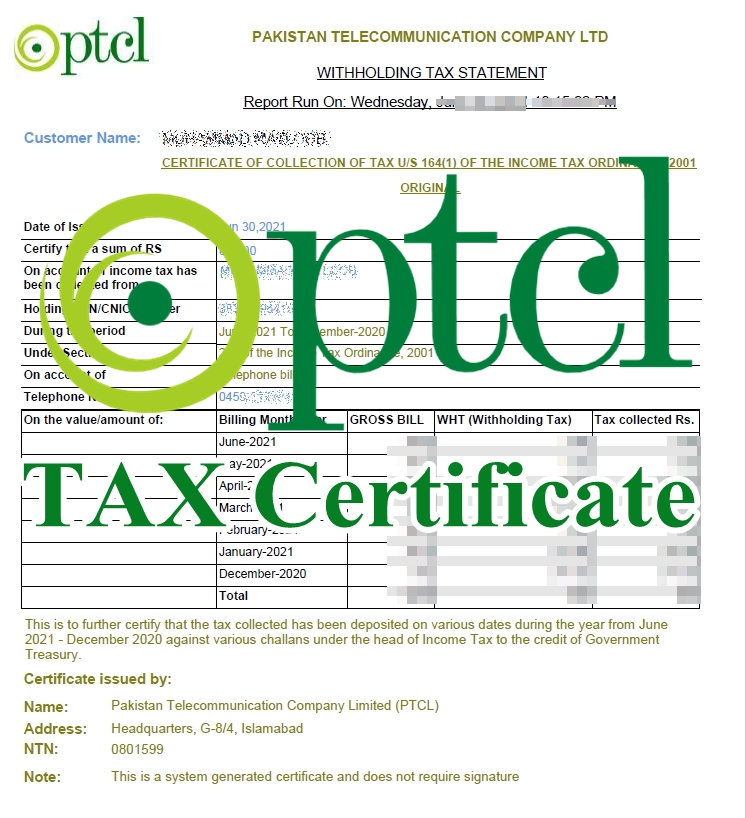

PTCL Tax Certificate Get your PTCL WHT Tax Deduction Certificate

Tax rate. Payment to non-resident director. 24% (22% from 01 Jan 2016 to 31 Dec 2022) Payment to non-resident professional/ firm (unincorporated business) 15% on gross income or prevailing non-resident individual rate on net income. Payment to non-resident public entertainer. 15% on gross income.

Withholding Tax (WHT) Calculation SAP Blogs

Withholding tax merupakan salah satu sistem pemungutan pajak yang diterapkan di Indonesia. Dengan sistem ini, Direktur Jenderal Pajak dapat menunjuk wajib pajak sebagai pihak ketiga untuk melakukan administrasi pemotongan/ pemungutan pajak, mulai dari menghitung, menyetor, dan melaporkan pajak terutang. Sistem withholding tax atau juga dikenal.

Wht withholding tax concept with big word or text Vector Image

Berjalannya sistem withholding tax di Indonesia akan dikenakan kepada seluruh penghasilan dari kegiatan usaha, sebagaimana yang telah diatur dalam Peraturan Direktur Jenderal Pajak Nomor 70 Tahun 2007. Implementasi sistem ini juga telah diatur dalam Undang-Undang Nomor 7 tahun 1983 tentang perlakuan withholding tax dalam PPh, yaitu terhadap.

Withholding TAX คืออะไร? ใครบ้างต้องจ่าย

3. Withholding tax scope in KSA under the domestic tax law and Double Taxation Agreement 3.1. Key categories of income subject to WHT 3.1.1. WHT is an income tax imposed on non-residents who generates income from a source in the Kingdom. 3.1.2. WHT is essentially imposed on payments from a source in the Kingdom made

Tax changes 2019 withholding tax VGD

Withholding tax adalah salah satu sistem pemotongan atau pemungutan pajak, di mana pemerintah memberikan kepercayaan kepada wajib pajak untuk melaksanakan kewajiban memotong atau memungut pajak atas penghasilan yang dibayarkan kepada penerima penghasilan sekaligus menyetorkannya ke kas negara. Bisa diartikan pula bahwa sistem withholding tax.

Everything You Need to Know About Double Tax Treaty Withholding Tax (WHT) WTax

Domestic Article 23 WHT is payable at the rate of 2% for most types of services where the recipient of the payment is an Indonesian resident and 15% for a variety of payments to resident corporations and individuals. For non-residents, Art. 26 WHT of 20% is applicable.

HOW TO FILE WITHHOLDING (WHT) TAX ON TAXPROMAX YouTube

They have also been revised to reflect certain income tax rate increases enacted under Chapter 59 of the Laws of 2021 (Part A). Accordingly, effective for payrolls made on or after January 1, 2022, employers must use the revised withholding tax tables and methods in this publication to compute the amount of New York State taxes to be withheld

eWithholding Tax คืออะไร เรื่องยากจะกลายเป็นง่าย Station Account

Withholding tax atau WHT merupakan pemotongan pajak oleh pihak ketiga atau perusahaan dari gaji karyawannya dan kemudian dibayarkan langsung kepada pemerintah. Jumlah yang dipotong untuk WHT ini adalah besaran pajak penghasilan yang harus dibayar oleh karyawan tersebut selama satu tahun. Sebagai penjelas, WHT umumnya diambil dari pihak yang.

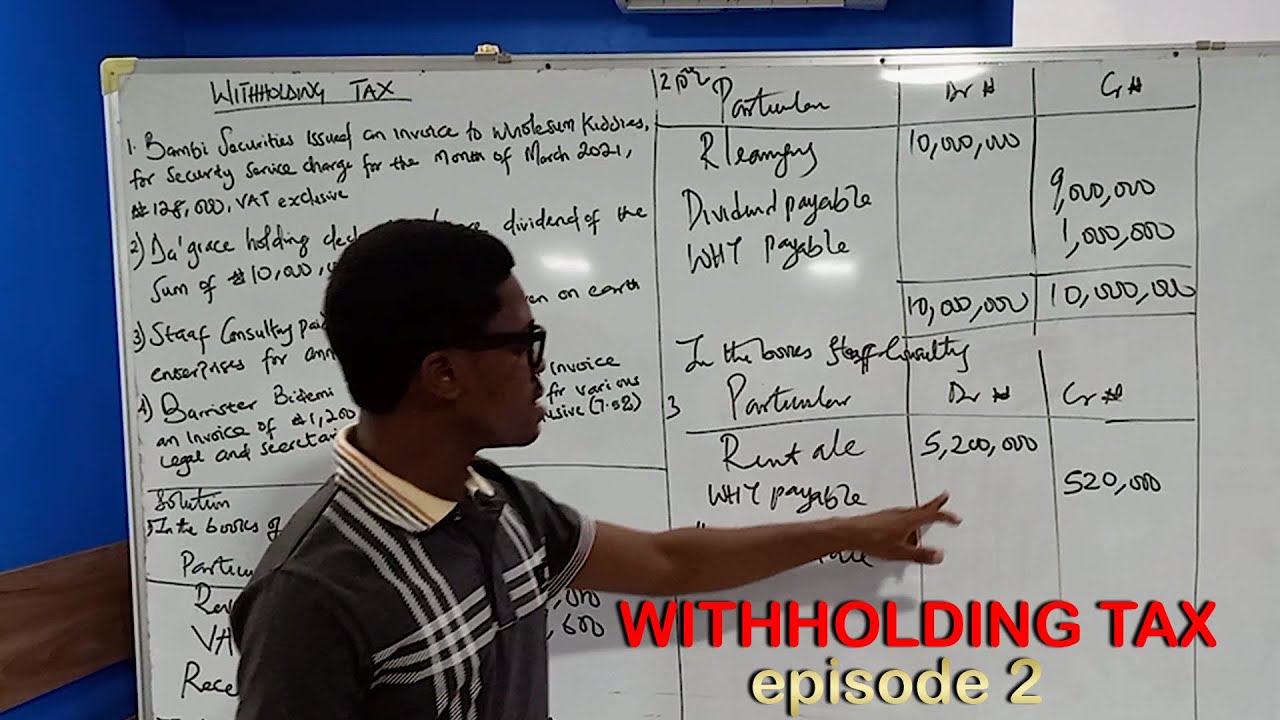

VAT & WHT (Withholding Tax) Episode 2 YouTube

Jenis-jenis yang Menggunakan Sistem Withholding Tax. Jenis-jenis pajak yang penyetorannya bisa menggunakan sistem withholding Tax, di antaranya: #1 Pemotongan PPh Pasal 21. PPh Pasal 21 adalah pajak yang dipotong dari penghasilan yang berhubungan dengan pekerjaan, jasa, dan kegiatan yang dilakukan oleh Wajib Pajak (WP) Orang Pribadi Dalam Negeri.

Tax Advisor Instant Tax Solutions A Special note on Withholding Tax

It is a tax of 1.45% on your earnings, and employers typically have to withhold an extra 0.9% on money you earn over $200,000. FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds.

Withholding Tax Filing in Nigeria

Withholding tax is income tax withheld from employees' wages and paid directly to the government by the employer, and the amount withheld is a credit against the income taxes the employee must pay.